Here’s a selection of OUTFRONT CEO Jeremy Male’s comments at the JP Morgan Global Technology, Media and Communications Conference this week.

Programmatic is sold at a premium

If you look at our programmatic business…you’ll see we’re getting a buck extra cpm on programmatic…

OUTFRONT is pushing rate

We still have relatively low CPM’s compared to the other media out there. I think there’s significant opportunity to drive rate. The vast majority of our sales force haven’t been through an inflationary environment. So we’re almost having to do inflation 101…it’s fine to go after 7-8%.

The OUTFRONT lease portfolio

90% of leases are fixed with kickers. 10% are revenue share. We budget for our fixed lease costs to go up a couple percent a year…in rural areas we may have a lease cost of 15-20% or revenue. In Times Square we may have a lease costs of 80% of revenue.

The Pacific Outdoor Portland plant purchase

We announced a great deal for us in Portland a couple weeks back. We don’t have that much in the Northwest…Normally we kind of just take the leases but this time we had…25 people come with the business…Our national sales are on average 45%. In Portland they are 10%. So there’s opportunity there for us to leverage our national sales force…There are 2-3 other deals which are around at the moment…It is a little bit frothy. It’s possible that private market multiples may start decreasing to reflect public market multiples.

Leverage declining

We expect to get down to the high 4’s EBIDTA to net Debt later this year. Over time we’d like to get that down to 4-ish. We’d like the target to be between 4 and 5. If we ever got below that we’d consider stock buybacks.

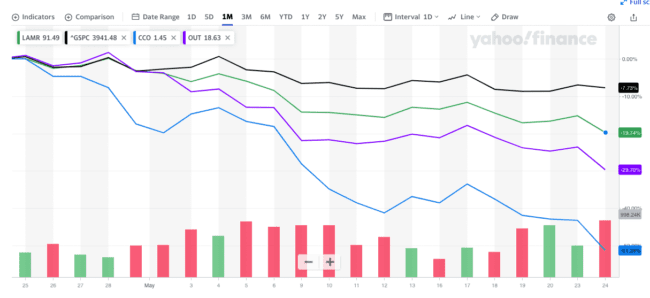

Billboard Insider’s take: Interesting to hear Male wonder whether private market out of home valuations may decline in line with public market out of home valuations. The last month hasn’t been kind to the public out of home companies due to recession worries. Lamar is down 20%, OUTFRONT down 30% and Clear Channel Outdoor down 50%.

1 month stock performance for Lamar (green), S&P 500 (black), OUTFRONT (purple) and Clear Channel Outdoor (blue)

[wpforms id=”9787″]

Paid Advertisement

Outfront Media is all about beating down the landlord , same for all companies. Odd he says lease cost in rural areas is 15-20% or revenue. They call you with all these big plans for your interstate property that is a gateway to Tampa , offer 20 % when they are paying you 25% currently. They hand you a blank lease for a digital sign and don’t mention a second Digital sign seen from north and south in and out of Tampa. The lease just says they can modify the sign. You hire someone to work the deal for you, involve an attorney, run up a big bill, they never make an offer or attempt to negotiate . They’ve worked your property site for seven months and pull out because you sought help from an expert. They want the landlords to see dollar signs with no legal advise. We are no longer mom and pop uninformed landlords. Business has always been a dog eat dog world, and they will tell you that. A fair price is only fair when it’s good for both parties. You sign that lease and you have given up all rights to your property and they own you for 20 years. Not me, not anymore. Seems Billboard Insider no longer publishes independent articles with a variety of information from big business to information for property landlords. I miss that.

Great read!