Clear Channel Outdoor Revenue grew but cashflow (adjusted EBIDTA) declined during the first quarter of 2023. Here are the results of the Clear Channel Outdoor 1Q 23 earnings release, investor deck and conference call.

- Consolidated revenue excluding FX grew 7% to $545 million as growth in the company’s European operations offset a decline in the US and airports segments.

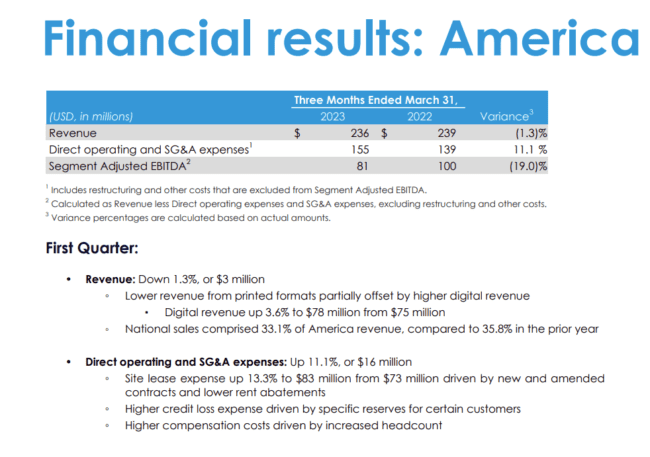

- Clear Channel Outdoor CEO Scott Wells and CFO Brian Coleman said they were disappointed with the performance of the company’s Americas segment. US revenues declined 2% in the first quarter of 2023 reflecting a pullback in media, telco and banking. Cashflow is down 19% due to higher lease costs, bad debt reserves and a higher headcount. Here are the results for the company’s US billboard business.

- Consolidated Adjusted EBIDTA declined 20% to $53 million due to higher lease costs, compensation expense and reserves taken for certain customers.

- Capital spending was $38 million during the first quarter of 2023. In addition the company spent $6 million on tuck-in acquisitions.

CEO Scott Wells on weak results in the US.

US revenue impacted by weakness in certain national accounts rather than macro events. These included accounts doing layoffs, select categories like crypto and emerging tech and select markets like San Francisco and Chicago rather than broad macro events. We are dissatisfied with the results in the US…thus far the second quarter revenue is looking better than the first quarter in terms of year over year growth…we have a lot of exposure to San Francisco. San Francisco was a very tough ad market in Q1. It’s our second largest market

Wells says any more European sales will be delayed until the European business improves

As the businesses perform it will give the counterparties more confidence in buying and us more confidence in selling…we’re not going to be foolish in doing transactions that are unattractive…

Billboard Insider’s take: Weak US revenue. Declining cashflow. No Europe sale prospects. Leverage twice what it needs to be. Clear Channel declined 12.7% on a day when OUTFRONT declined 0.1%, the S&P 500 declined 0.5% and Lamar grew 0.1%

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement

CCO needs to reduce debt. Shed European markets, sell some U.S. markets, staff reductions. Stock price will never rise, debt will

never go down until they face reality.