Lamar Advertising is refinancing $650 million of corporate debt. Here’s are some excerpts from the press release.

BATON ROUGE, La., Jan. 04, 2021 (GLOBE NEWSWIRE) — Lamar Advertising Company (LAMR), a leading owner and operator of outdoor advertising and logo sign displays, today announced that its wholly owned subsidiary, Lamar Media Corp. (“Lamar Media”), intends to redeem in full all $650,000,000 in aggregate principal amount of its outstanding 5 3/4% Senior Notes due 2026 …The redemption is conditioned on Lamar Media completing one or more new debt financing transactions totaling at least $550.0 million…If the Financing Condition is met, Lamar Media expects to redeem the Notes on the Redemption Date at a redemption price equal to 102.875% of the aggregate principal amount of the outstanding Notes, plus accrued and unpaid interest to (but not including) the Redemption Date (the “Redemption Price”).

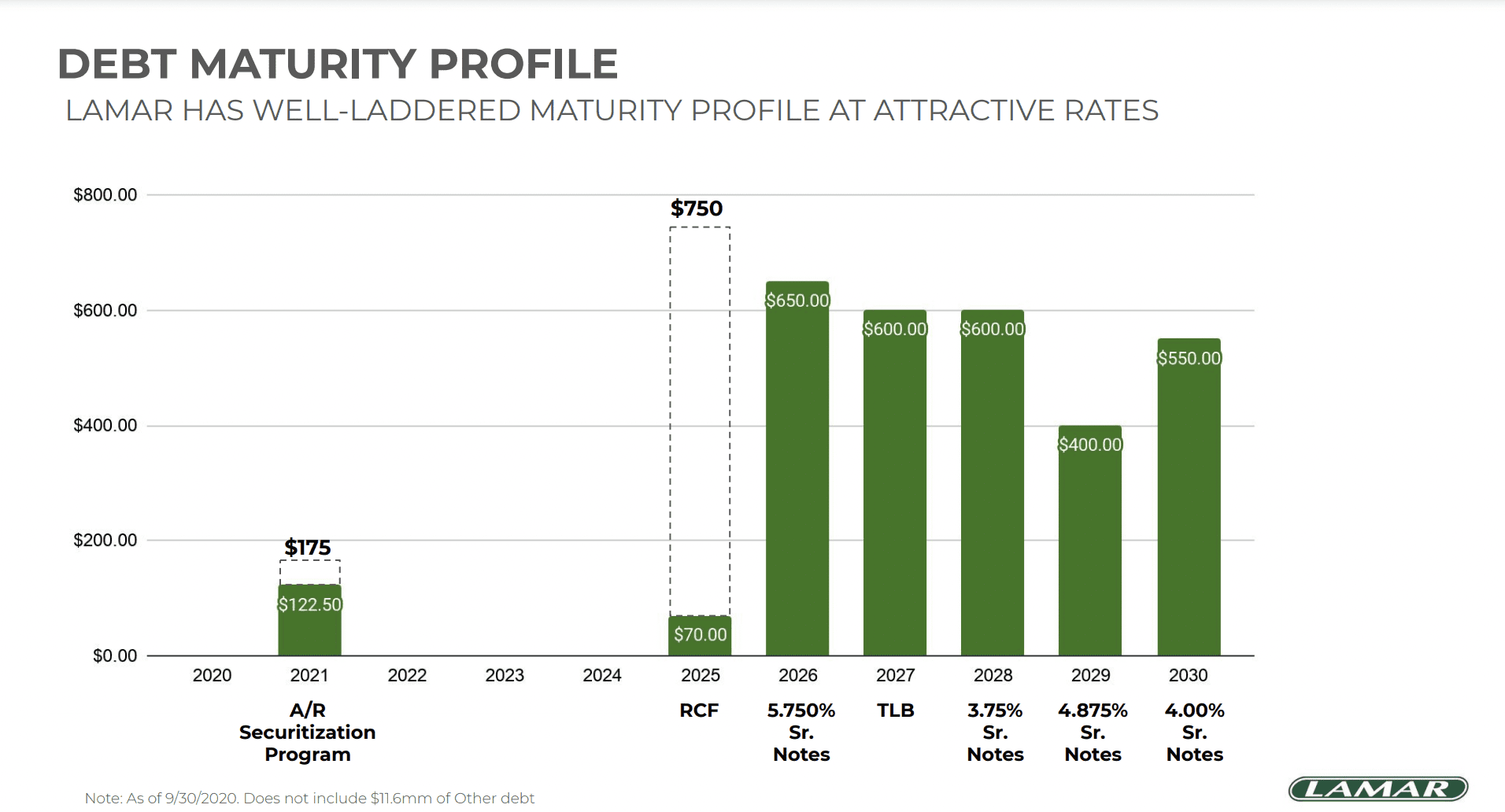

Insiders’ Take: Last week Paul Wright told the Billboard Insider podcast that interest rates are low and it’s a good time to think about refinancing debt. This chart explains what Lamar is doing.

The $650 million 2026 5.75% notes are the earliest significant maturity on Lamar’s balance sheet and are more expensive than Lamar’s other long term debt. The capital markets have remained open to all the public out of home companies during Covid and Lamar’s financials have recovered faster than OUTFRONT or Clear Channel. Smart move for Lamar to refinance.

[wpforms id=”9787″]

Paid Advertisement