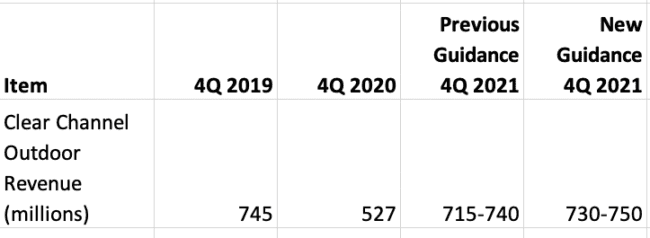

Clear Channel Outdoor stock rose 8% yesterday after the company announced it will consider selling their European business. Clear Channel Outdoor also increased fourth quarter 2021 revenue guidance. It raised fourth quarter revenue growth by 2%. Fourth quarter consolidated revenues are projected to grow 39-42% and return to pre-covid levels. See table below.

Billboard Insider thinks a European sale will be a good thing.

- The parts will be worth more than the sum of the whole because the market will apply a higher valuation to a smaller easier to understand business.

- The company’s North American managers will have tighter focus without international distractions

- A European sale will reduce debt. Clear Channel Outdoor’s international business was generating $202 million in annual cashflow prior to covid. A sale at 12 times cashflow would generate $2.4 billion and reduce Clear Channel Outdoor’s debt from $5.7 billion to $3.3 billion. The European sale may not reduce the company’s leverage (currently above 10 times cashflow) to the 5-6 times cashflow sustainable level, but it will be a step in the right direction especially if the company prunes corporate overhead after shedding more than half of its revenues.

[wpforms id=”9787″]

Paid Advertisement