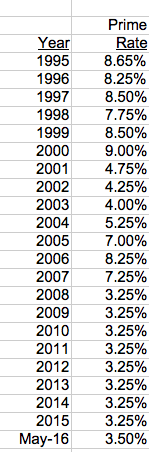

The federal reserve may raise interest rates according the the New York Times. Interest rates have been low for the 8 years since the Great Recession. Rates can rise pretty fast in the later stages of a recovery. The following chart shows that the Prime rate rose from 4% in 2003 to 8.25% in 2006. You need to be thinking now how you will handle in increase in interest expense if your borrowing costs rise by 4-5%. A 1% rate rise translates into an additional $10,000 in annual interest expenses if you’ve borrowed $1 million.

The federal reserve may raise interest rates according the the New York Times. Interest rates have been low for the 8 years since the Great Recession. Rates can rise pretty fast in the later stages of a recovery. The following chart shows that the Prime rate rose from 4% in 2003 to 8.25% in 2006. You need to be thinking now how you will handle in increase in interest expense if your borrowing costs rise by 4-5%. A 1% rate rise translates into an additional $10,000 in annual interest expenses if you’ve borrowed $1 million.

Try to lock in a rate if your lender does fixed rate lending. The other alternative is to pay down your debt as fast as you can to reduce your exposure to interest rate fluctuations.

United State Prime Rate 1995-2016

Source: St Louis Federal Reserve

Paid Ad