By Chris Stark, Stark Capital Solutions

When I got started in the billboard industry over 20 years ago, valuations of billboard transactions were always referred to in terms of a multiple of revenue.

Wow, valuation talk was so simple back then!

There is no doubt that acquirers back then were doing more sophisticated analysis on transactions in order to determine what cash flow the revenue produced from one company to the next. However, because lease terms and expense structures were more consistent, looking at simple revenue multiples was an easy way to estimate market value.

With more companies purchasing perpetual easements, and/or having higher percentage revenue share agreements on more valued locations, you really do have to focus on cash flow vs revenue in order to determine what a company is worth.

Here is where the confusion comes in: CASH FLOW IS IN THE EYES OF THE BEHOLDER.

Everyone views cash flow differently. I am amazed how many times I have conversations with very knowledgeable industry veterans about the same transaction and hear one party say the company sold for 8x cash flow and the next tell me it sold for 14x. And they both might be correct!

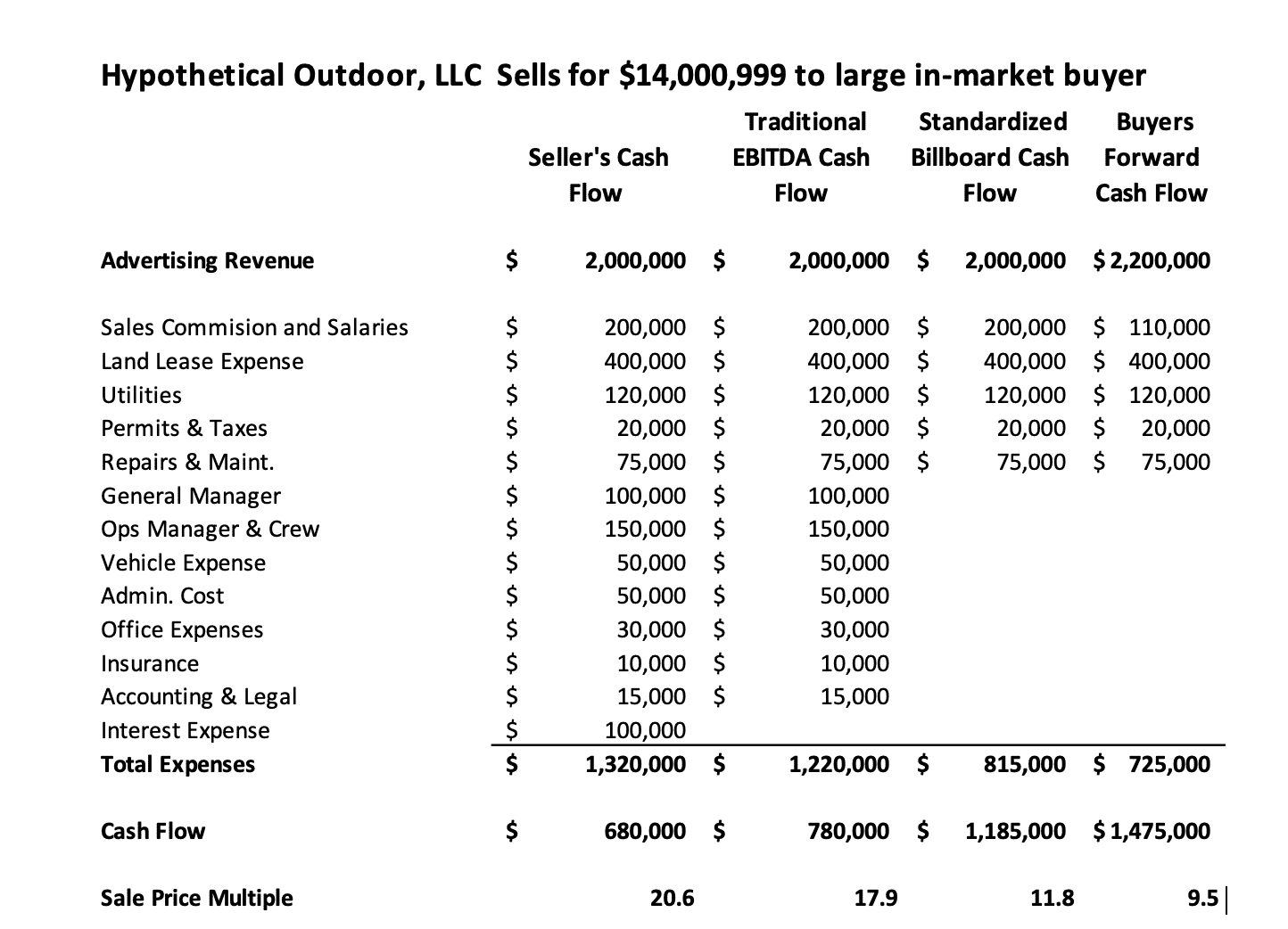

Let’s take an example:

Imagine having separate conversations with people involved in the above transaction:

-The seller might tell you they sold for over 20x.

-The buyer might indicate they purchased at under 10x.

-The lender might view it as 17.9x.

-The investment banking advisor might list it as a 11.8x multiple.

No wonder this is so confusing!!

So why is this important? Because not understanding the market value can cause an owner, lender, or buyer to make wrong decisions. A seller might pass on a great deal, a buyer might overpay or a lender might miss a good lending opportunity (or even lend too much money).

Between Stark Capital’s financing activities and advisory involvement, we have a deep databased of past acquisition transactions. When we track data, we use the Standardized Billboard Cash Flow formula from the above example. Based on this calculation, we see multiples range consistently between 8-12x. There are outliers, but the majority fall in this range when using the described formula.

Due to the differing ways involved parties may view Billboard Cash Flow multiples, we have had countless conversations with people involved in transactions from our own database who will quote different multiples. They are not wrong. They are just using a different formula.

If you want to learn more about cash flow, or discuss options to ensure you get the best deal when purchasing or selling your billboards, contact us.

[wpforms id=”9787″]

Paid Advertisement