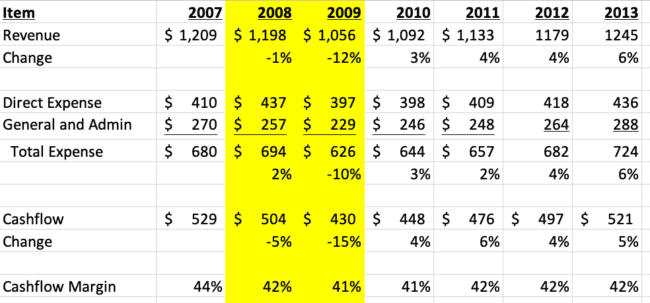

Sean Reilly tells investor conferences that he’s managed through three recessions at Lamar. It’s instructive to look at what Lamar did during the last recession for tips on how to weather the covid-19 recession. From 2007-2009, Lamar’s revenue declined by 12% and cashflow declined by 18%, but the corporate cashflow margin stayed in excess of 40% and the company met all financial commitments.

Lamar Financial Performance During the 2007-2009 recession

Three lessons emerge from Lamar’s experience.

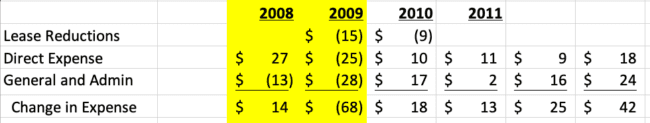

Everything is on the table.

Lamar squeezed $81 million or 12% out of expenses during 2008-2009. Corporate overhead accounted for half the cuts. Lease expense counted for one quarter of the cuts, other direct operating expenses (vinyl, production, maintenance, regional offices) counted for one quarter of the cuts.

How Lamar Cut Expenses in the Great Recession

Cut corporate overhead first.

Lamar cut overhead by $8 million in the first year of the recession. Cuts in the field will be more palatable if you lead by cutting central office expenses. Makes no sense to ask others to sacrifice if you don’t sacrifice yourself.

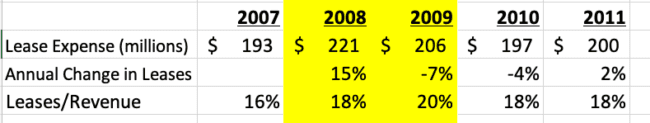

Cut real estate costs.

Lamar cut real estate costs by almost 10% from 2008-2010 and kept lease costs below 20% of revenue. If you haven’t sent your landlords a letter asking for a 20% covid-19 reduction in rent you should. Some leases have language which allows you to reduce rent if traffic is reduced or if “a sign’s value for advertising purposes is reduced”. Cite those clauses. If your lease doesn’t have those clauses then you may need to suggest that you’ll take the sign down if you can’t reach an agreement.

Lamar Lease Expense During the Great Recession

Insider has recently heard from several landlords who have been asked for a 20-25% reduction in rent by their out of home company.

What are you doing to manage expenses? Let Insider know using the form below.

[wpforms id=”8663″]

Paid Advertisement