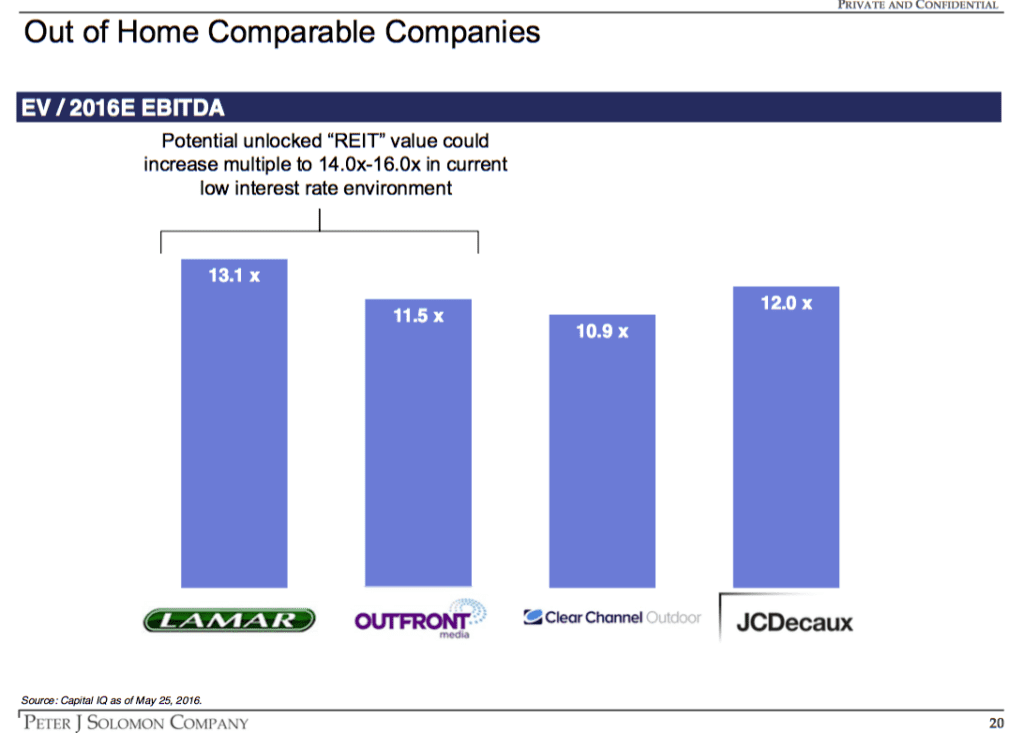

Insider thought you might want to see what the stock market thinks of the Big 4 Outdoor companies: Lamar, Outfront, Clear Channel and JCDecaux. The chart below comes from investment banker Mark Boidman’s presentation titled OOH and M&A.

The Chart demonstrates that the stock market values Lamar at 13.1 times estimated 2016 cashflow (EBIDTA), JCDecaux at 12 times estimated 2016 cashflow, Outfront at 11.5 times estimated 2016 cashflow and Clear Channel at 10.9 times estimated 2016 cashflow.

Source: OOH and M&A – A Look Ahead by Mark Boidman, Managing Director, Peter J Solomon Company.

Insider sees two takeaways from this chart:

- Lamar trades at a 20% premium to Clear Channel. The market thinks: (a) Lamar has better management and will get more out of its assets (b) Lamar has much less debt and therefore less risk so dollars farther into the future can be counted into the valuation, or (c) a little bit of both.

- Now you can see why Clear Channel is trying to sell it’s plant at 12.5 times cashflow. By selling at 12.5 times cashflow Clear Channel is receiving 15% more value per dollar of cashflow than the market currently recognizes.