In EBIDTA and Billboard Cashflow and Why You Need to Know the Difference, Billboard Insider commented that out of home companies trade at 8-12 times billboard cashflow (e.g. revenue less lease costs, electricity, property taxes and a sales commission of 5-10%).

In EBIDTA and Billboard Cashflow and Why You Need to Know the Difference, Billboard Insider commented that out of home companies trade at 8-12 times billboard cashflow (e.g. revenue less lease costs, electricity, property taxes and a sales commission of 5-10%).

A Billboard Insider reader writes, “I find your article of July 20, 2023 about billboard valuations helpful. Do the valuations you speak of include ownership of the land underneath the billboard and/or a purchased permanent easement. What difference does a purchased easement or land ownership make to a billboard’s value?”

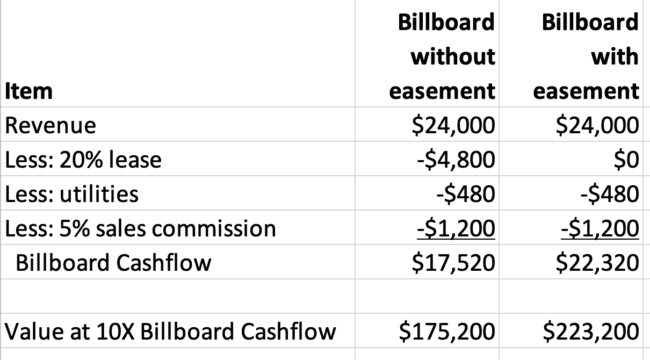

Billboard Insider’s take: A portion of the value of an easement or land ownership is automatically included in 8-12 times billboard cashflow multiple. If you own an easement or title to land under a billboard you have no lease costs on the billboard so the billboard cashflow multiple will capture part of the value of the easement. Take this example. Two static billboards sell for 10 times billboard cashflow. One of the billboards has an easement. One doesn’t. The billboard with an easement will be worth 27% more because Billboard Cashflow is higher.

The analysis doesn’t simply end there. The billboard with an easement will probably also sell for a higher multiple of billboard cashflow than the billboard without an easement. A billboard with an easement lowers business risk because there’s no concern about lease renewal. In addition a permanent easement means high profits in the future because there will be no inflation in lease expenses. An asset with lower risk will sell at a higher cashflow multiple than an asset with high risk.

When Billboard Insider asks brokers what billboard easements are worth we hear as much as 10-14 times annual rent which is another way of saying that a billboard with an easement will sell for a higher multiple of billboard cashflow than a billboard without an easement.

How much value can an easement add to a billboard’s value? We’d love to hear what you brokers and bankers and appraisers think. Email davewestburg@billboardinsider.com or use the comment box below and we’ll run a followup post.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Great article. Nuggets of great information!!