By Norm Chait, Director of Out-of-Home Product & Sales at Ubimo a Quotient brand

This past year has caused a shift in consumer behavior. Instead of happy hours at local bars, we are celebrating with virtual cocktail hours. We have traded out in-office snacks for mid-day raids to our own kitchen cupboards. Quotient’s data shows that both alcohol and snack sales have increased during COVID as people seek comfort and enjoyment while social distancing at home.

We examined the data to find out what food and beverages proved most popular and what demographics indulged in these trends. With this knowledge of consumer behavior, brands and advertisers can use Out-of-Home (OOH) advertising to reach these customers.

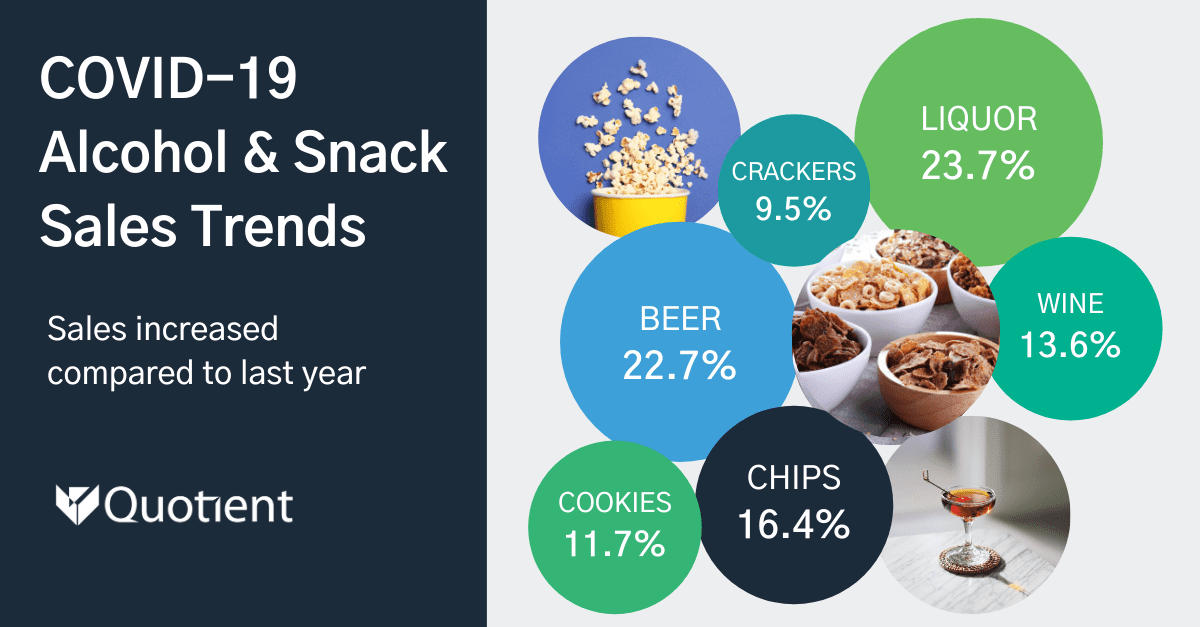

Alcohol & Snack Trends

With people spending more time at home instead of going out to bars or restaurants, alcohol and drink sales have experienced a spike. During COVID in 2020, alcohol sales increased 19% compared to the same period in 2019 and snack sales increased 13%.[1] In the alcohol category, liquor sales experienced the highest lift—showing a 23.7% sales increase compared to 2019. In the snack category, chips emerged as the most popular snack product—with sales up 16.4% compared to .[2]

Demographic Trends

Digging deeper into the data reveals some demographic trends. For example, 25–34-year-olds saw the highest sales lift of any age group for alcoholic beverages. Compared to 2019, they spent 29.2% more in the alcohol category during COVID. Households with incomes above $150,000 saw the highest lift in purchasing of snacks. During COVID, these households spent 30.8% more on snacks than the previous year.[3]

Reaching Consumers with OOH

Advertisers and retailers can use this data to inform campaign strategies and reach the audiences that matter the most. As consumers spend more on alcohol and snacks in the grocery store, advertisers should promote their brands on media that meets them in their shopper journey. Quotient data shows that 8 out of 10 grocery store shoppers view OOH advertising. Brands can use OOH screens to reach their target audience as they go to the grocery store to stock up on drinks and snacks, thus engaging them when purchase intent is high.[4]

While COVID-19 has changed shopper behavior in many ways, the long-lasting effects of these changes are still up for grabs. Many shoppers have trialed new brands during COVID-19, and with increased category sales across the snack food and alcoholic beverage sectors, now is the time for advertisers to capture these curious consumers and create long-lasting buying habits. Brands can tap into shopper behavior insights to ensure they’re delivering the right message to the right shopper at the right time using OOH.

[1] Quotient Internal Data (3/1/20-10/31/20 vs. 3/1/19-11/30/19)

[2] Quotient Internal Data (3/1/20-10/31/20 vs. 3/1/19-11/30/19)

[3] Quotient Internal Data (3/1/20-10/31/20 vs. 3/1/19-11/30/19)

[4] Ubimo Data (May-July 2020)

[wpforms id=”9787″]

Paid Advertisement