Clear Channel Outdoor has failed to sell their European assets. Clear Channel execs say that they may try to sell certain pieces. There are three problems with keeping Europe.

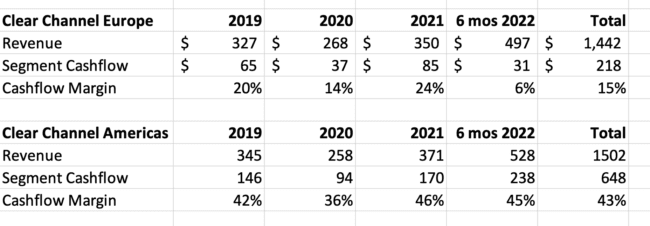

First, Clear Channel Europe operates at lower margins. Look at this table which compares the segment cashflow (e.g. segment cashflow prior to interest expense or corporate overhead) for Clear Channel Europe and Clear Channel Americas since 2019. Clear Channel Europe operates at a cashflow margin which is one-third of Clear Channel Americas. Covid hit the European transit plant badly and the transit contracts have high costs.

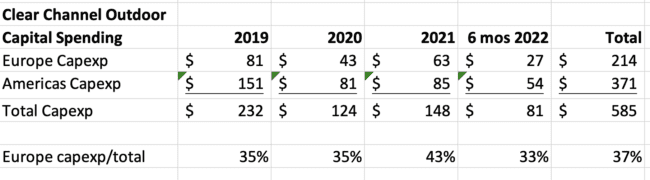

Second, Clear Channel Europe is the slacker child who asks for a big allowance. Despite having poor returns, Clear Channel Europe has accounted for 37% of Clear Channel’s total capital spending over the last three and a half years. Imagine if that $214 million has been put to work in the US converting static billboards to digital…

Third, most of Clear Channel Europe’s assets are not REIT qualified so Clear Channel Outdoor will never be able to be a REIT until it disposes of Europe.

[wpforms id=”9787″]

Paid Advertisement