Clear Channel is close to selling Europe. Billboard Insider wonders if Clear Channel executives might announce something on the August 9 second quarter earnings call. Two thoughts about the pending sale.

A sale is a win.

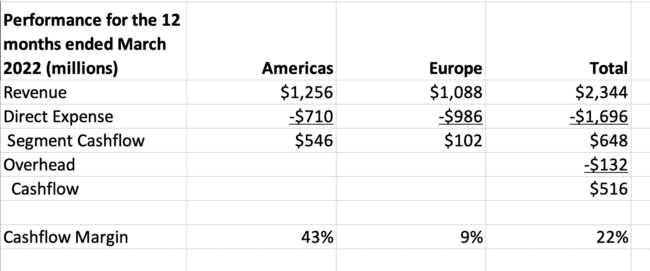

Clear Channel’s Europe business had a 9% cashflow margin for the 12 months ended March 2022, versus a 43% margin for Clear Channel’s North American business. Selling the underperforming Europe unit allows the company to focus attention and capital spending on the more profitable Americas group. In 2021 Clear Channel Outdoor spent $63 million or 43% of a $148 million capital budget on the underperforming European segment. That’s money which should be spent in North America at a much higher return.

How much of a win depends on the price.

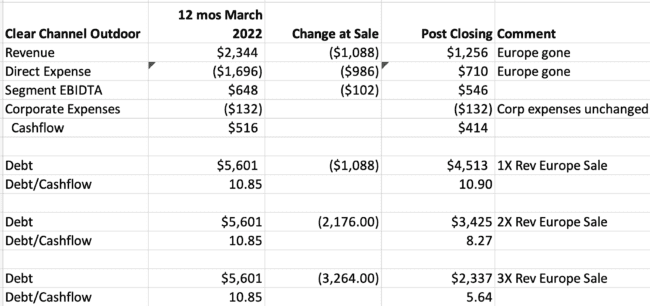

A sale of Clear Channel Europe at 1 times revenue or 10 times Europe Cashflow or $1 billion is a small win. It leaves Clear Channel Outdoor’s leverage (total debt/EBIDTA) unchanged at a still high 10.9, but sheds an underperforming division which requires almost as much capital annually as the Americas. An improvement but not enough to open the capexp and acquisition spigots.

A sale of Europe at 2 times revenue or 20 times Europe Cashflow or $2.2 billion is a medium win. It reduces Clear Channel leverage to 8.27 times, a level which is still too high for a REIT conversion and a level which will limit capexp and acquisitions. Nevertheless is sets the company on a course to sustainability.

A sale of Europe at 3 times revenue or 30 times Europe segment cashflow or $3.3 billion is a big win. It reduces Clear Channel Outdoor debt to 5.6 times cashflow. Billboard Insider considers 5 times cashflow as a sustainable long term level of debt for an out of home company because it allows for payment of all debt over 10 years with no improvement in revenue. It also provides room to pursue digital sign conversions, growth projects and acquisitions. A REIT becomes a possibility as well.

Here’s the analysis. We conservatively assumed Clear Channel Outdoor does not trim corporate expenses post-sale although we think the company should cut corporate overhead because it is shedding nearly half its revenue.

Insider’s take: If you think Scott Wells will get a good price for Europe you might want to buy Clear Channel stock now.

[wpforms id=”9787″]

Paid Advertisement