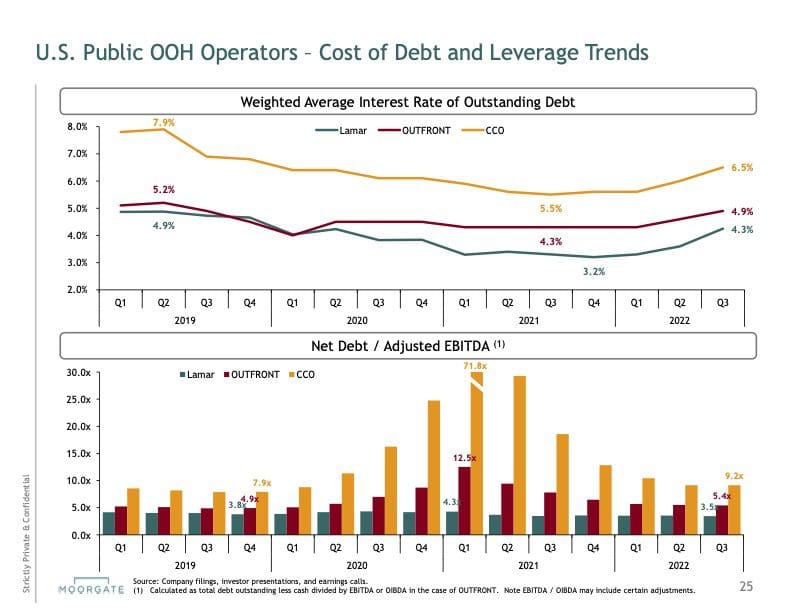

Moorgate Capital Partners has prepared an analysis of the Cost of Debt and Leverage (Net Debt/Adjusted EBIDTA) for the three public US Out of home companies. Clear Channel Outdoor has the highest leverage and the highest cost of debt. Lamar has the lowest leverage and lowest cost of debt. The cost of debt has been rising at each of the public companies during the past year due to an inflation induced rise in interest rates.

If you are interested in obtaining Moorgate’s Q3 OOH report contact Jeff Seddon, Vice President, Moorgate Capital Partners, jeff.seddon@moorgatepartners.com, 609-276-2508.

[wpforms id=”9787″]

Paid Advertisement