Seeking Alpha has run two pieces on billboard stocks this week. Outfront: A Long Term Investment Opportunity ran Monday . The financial analysis is shallow and simplistic but one sentence on OUTFRONT’s success at cross-selling transit and bulletins caught Insider’s eye:

“According to the figures provided by Outfront Media, 86 percent of its top 100 customers purchase transit and billboard media together. By providing one stop shop for their Out of Home media promotion requirements, the REIT is able to draw repeat business from its clients.”

The rest of the article is forgettable.

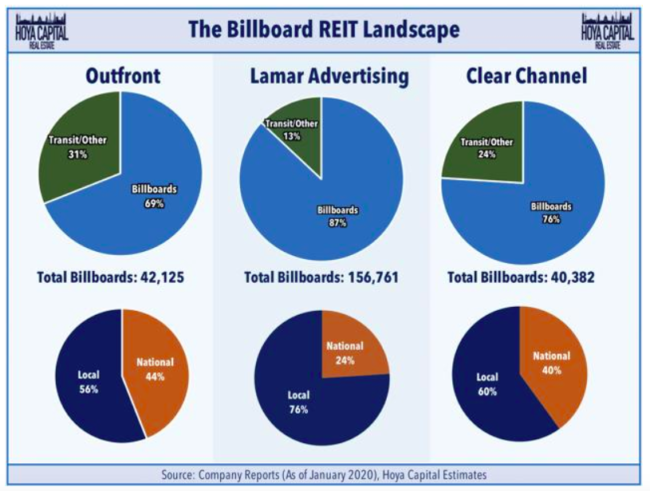

A much better piece was yesterday’s Billboard REIT’s: In Your Face, But Under the Radar. It compares the performance of Lamar and OUTFRONT and reviews the mechanics of operating an out of home company. A good read if you’re following the out of home industry or are thinking about entering the industry. Here’s a chart from the article summarizing the plant and revenue mix of OUTFRONT, Lamar and Clear Channel Outdoor.

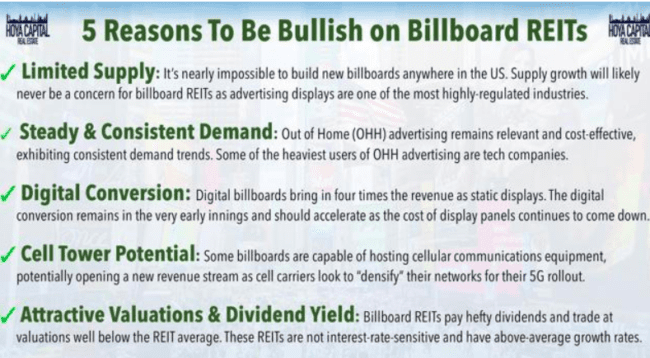

There’s a nice chart which summarizes the financial case for Billboard Real Estate Investment Trusts (REIT’s). Bring up these strengths the next time you meet your banker.

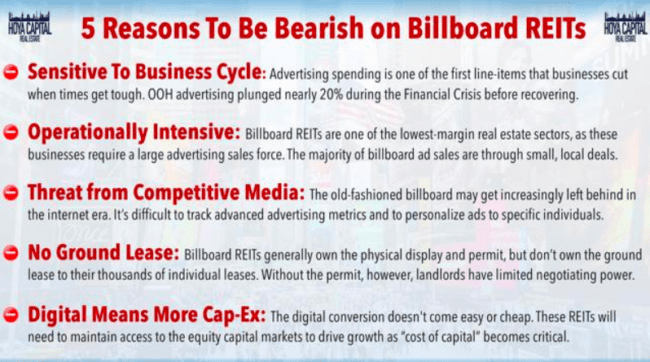

There’s also a chart which talks about the risks of Billboard REITs. Keep these in mind when you talk to your banker and have some talking points as to how you can mitigate them. We’ll write more about this next week.

Speaking of bankers, next week’s Billboard Insider podcast guest is Steve Haggard, CEO of Metro Phoenix Bank. Steve will explain why he likes the out of home industry and review out of home loan pricing and terms.

[wpforms id=”9787″]

Paid Advertisement