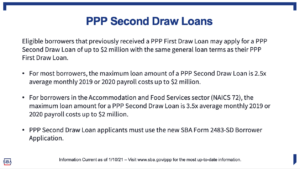

Applications for the next round of PPP loans should start showing up this week. Since the application portals are initiated by each bank in the program, timing may vary. Most banks will have already set up portals previously, Insider is expecting this should move quickly.

Let’s deal with some basic questions, courtesy of the SBA and highlights from their own frequently asked question presentation.

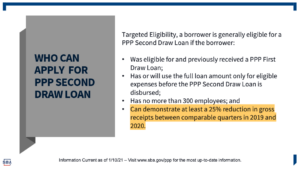

Insider knows that a number of OOH businesses already applied for and received a PPP loan in the first round in 2020. Also, many companies rebounded nicely and have seen operations continue to approve quarter by quarter. Interestingly, we have highlighted one of the eligibility conditions below.

Insider took a look at our related company, Circle City Outdoor, noting that our sales were only off 8% comparing 2019 to 2020, so on first blush we would think we could not apply for the second round. However, when comparing our second quarter 2020 to the same quarter 2019, our revenue fell 28% in that quarter during the core lockdown months. We do meet the criteria and would be eligible for the second round of PPP loans.

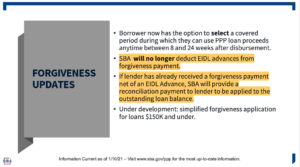

One other item we noted and highlighted below, focuses on those businesses that applied for an EIDL disaster relief grant (typically capped at $10,000). In the forgiveness application, if you received an EIDL grant and the full amount available to you on a PPP loan application, you were obligated to reimburse the grant as a part of your forgiveness application. This new round of funding removes the provision of deducting EIDL advances and allows a company who may have already reimbursed their EIDL advance to have a path to get that payment refunded.

As before, this is our read on the new legislation. You will want to consult with your bank our accountants to firm up details for your company.

[wpforms id=”9787″]

Paid Advertisement