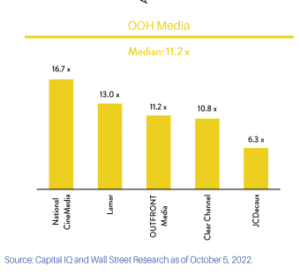

This table in Solomon Partners Media Monthly October 2022 caught Billboard Insider’s eye. It computes the total value of the public out of home companies as a multiple of 2022 estimated cashflow.

This table in Solomon Partners Media Monthly October 2022 caught Billboard Insider’s eye. It computes the total value of the public out of home companies as a multiple of 2022 estimated cashflow.

The public out of home companies are trading at a median multiple of 11.2 times 2022 estimated cashflow.

Lamar is at 13 times cashflow, followed by OUTFRONT at 11.2 times cashflow, Clear Channel Outdoor at 10.8 times cashflow and JC Decaux at 6.3X cashflow.

JC Decaux’s low multiple is due to low margins, short term transit contracts as well as the fact that the European and Asian transit plant has been slow to recover from covid and is weighed down by Ukraine war fears.

An out of home company which has lower growth prospects or higher risk will be valued at a lower cashflow multiple. Investors will include more years of cashflow in their company valuation if cashflow is growing. Investors will include fewer years of cashflow in a company’s valuation if they think there is a risk to future cashflow.

[wpforms id=”9787″]

Paid Advertisement