A Billboard Insider reader asks:

Hi Dave. One quick question. When you get ready to sell your plant is it more of and advantage to sell your land under your structures and get a perpetual easement, before selling. Or keep the land and sell it as a whole.

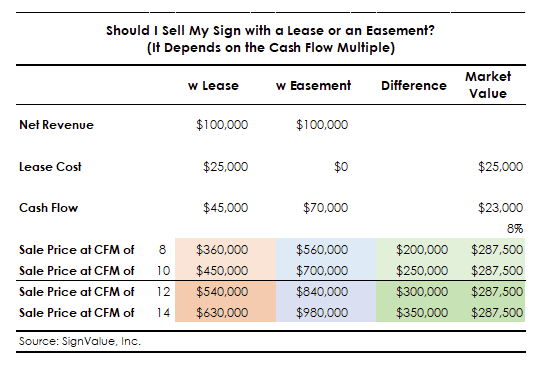

Out of home valuation expert Paul Wright of Signvalue says an easement drives interest, reduces sale times and increases a sign multiple.

We get this question from our seller clients quite often. There are a lot of variables that affect this decision like how quickly they want to sell, what is the remaining term of the lease, the market size, competition and growth potential, digital conversion opportunity, escalation rate, revenue share included in the lease, etc. Generally speaking, the question of whether a sign owner should sell their sign with a lease, or an easement largely depends on the cash flow multiple that they will achieve on the sale of the sign. As you can see from the calculations below, a sign that sells at a 10x cash flow multiple will still realize less than market value in that sale price when including an easement. However, a sign that sells at a 12x cash flow multiple will realize the value of the easement in the sale price. Just because a sign owner might squeeze more value out of their sign by bifurcating an easement, doesn’t always mean that is the best option for them. Many times, the fact that there is an easement included it will 1) drive up interest in a sign, 2) reduce the amount of time it takes to sell the sign(s) and 3) increase the multiple that buyers are willing to pay. In other words, depending on a sellers motivations, sometimes selling more quickly and creating more market demand is worth more than the incremental increase in total value.

Tomorrow out of home investment banker Jim Johnsen will provide his thoughts.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement