OUTFRONT revenues grew 14% in the third quarter of 2022. Here are the results of the OUTFRONT Media 3Q 22 earnings release and OUTFRONT Media 3Q 2022 earnings presentation.

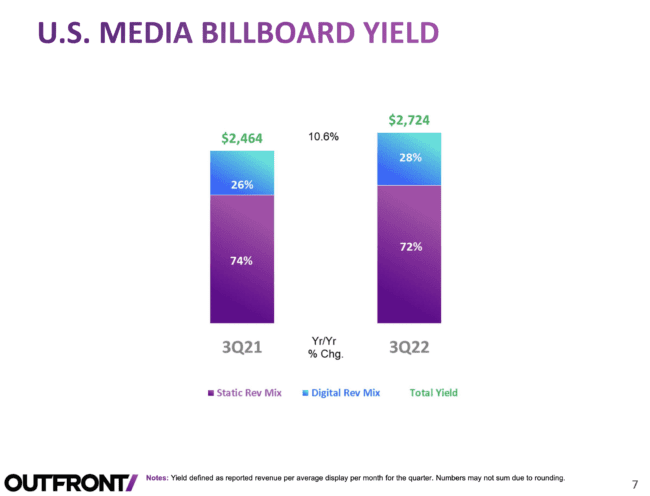

- Revenues increased 14% to $454 million in the third quarter of 2022. Billboard revenues grew 12%. Transit revenues grew 21%. National revenue grew 20% and local revenue grew 9%. The company finished the quarter with a $2,724 yield per average billboard display up 11% from the prior year.

- Operating expenses grew 17% due to higher transit fees and billboard lease costs.

- SG&A expenses increased 12% due to increased compensation, business travel and entertainment costs as well as an increase in provision for doubtful accounts.

- Adjusted cashflow (OIBDA) increased 10% to $128 million.

- The company ended the quarter with $2.7 billion in debt. The weighted average cost of debt is 4.9%. The company’s net leverage ratio (Debt-cash/long term EBIDTA) is a sustainable 4.9X.

- The company approved a cash dividend of $0.30/share payable on December 30, 2022. The $0.30 dividend is in line with the $0.30 dividend which was paid in March 22, June 22 and September 22. It equates to a 7% annual yield based on the company’s closing stock price of $17.05.

Billboard Insider’s take: Nice to see revenues and yields improving although OUTFRONT’s transit revenue has recovered slower than the rest of the US transit market. The company is reasonably leveraged (Billboard Insider considers anything below 5-6 times as sustainable) and a 7% dividend generates decent current returns.

[wpforms id=”9787″]

Paid Advertisement