OUTFRONT’s urban and transit plant had a 49% drop in revenue and cashflow during the second quarter of 2020 and CEO Jeremy Male expect third quarter revenues to be down 35-40% from the prior year. Here are the results from the OUTFRONT earnings release, OUTFRONT investor presentation and OUTFRONT earnings call.

OUTFRONT’s urban and transit plant had a 49% drop in revenue and cashflow during the second quarter of 2020 and CEO Jeremy Male expect third quarter revenues to be down 35-40% from the prior year. Here are the results from the OUTFRONT earnings release, OUTFRONT investor presentation and OUTFRONT earnings call.

- Revenues declined by 49% to $233 million during the second quarter of 2020. As CEO Jeremy Male said, “audiences were better above ground than below.” Transit revenues were down 71%. Billboard revenues declined 38%. The company’s billboard yield (average monthly revenue per display) declined from $2,265 during the second quarter of 2019 to $1,462 during the second quarter of 2020.

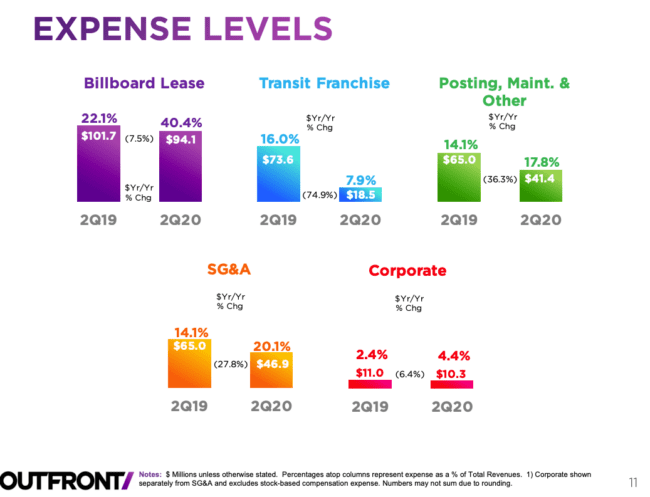

- Operating expenses declined by 36% to $154 million. Transit fees, posting and maintenance and SG&A took the biggest cuts. Lease expense and corporate overhead took the smallest cuts.

- Adjusted cashflow (OIBDA) declined by 85% to $22 million during the second quarter due to reduced revenue.

- Capital expenditures declined from $21 million in the second quarter of 2019 to $14 million in the second quarter of 2020 as the company postphoned discretionary projects to conserve cash.

- The company added 97 new MTA digital displays during the quarter bringing the total number of MTA digital displays to 5,278.

- Male expects third and fourth quarter results to improve: “For the third quarter we expect billboard revenue to be down around 25% and transit to be down around 65%…this takes us to total revenues down in the 35-40% range which is a positive step up from the second quarter…It’s our anticipation that the fourth quarter will show further sequential improvements in both parts of our business.”

Insider’s take: The worst is over. OUTFRONT has nearly $1 billion in cash and bank line availability. It received covenant relief from lenders. The MTA has reduced 2020 payments. Revenues have begun to rebound although it will take longer for OUTFRONT’s urban and transit plant to recover than Lamar’s roadside billboard plant. Seems unfair that corporate takes the smallest expense cut when OUTFRONT is belt-tightening. You need to lead by example. OUTFRONT was up 2.4% in afterhours trading.

[wpforms id=”9787″]

Paid Advertisement