Not good, but improving is how Insider summarizes OUTFRONT’s third quarter 2020 earnings. Here are the results from OUTFRONT’s 3Q 2020 earnings release, earnings deck and conference call.

Not good, but improving is how Insider summarizes OUTFRONT’s third quarter 2020 earnings. Here are the results from OUTFRONT’s 3Q 2020 earnings release, earnings deck and conference call.

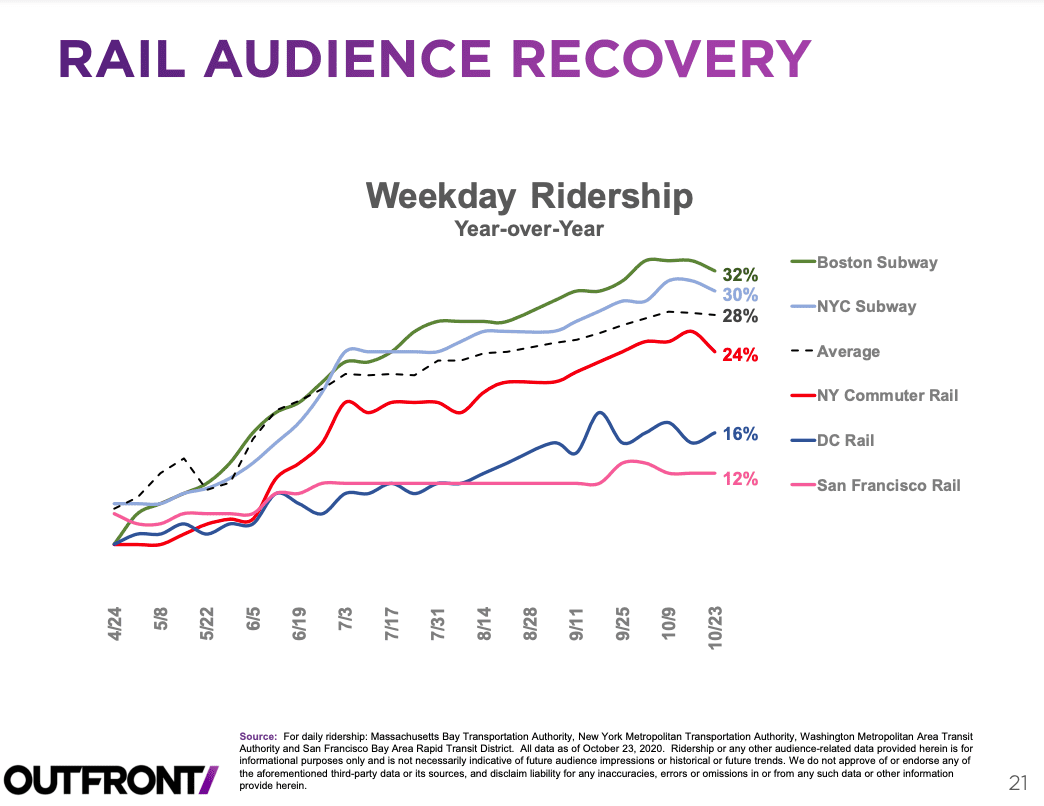

- Revenues declined 39% to $282 million during the third quarter of 2020 as primarily because transit revenues are lagging due to low ridership. Billboard revenues were down 23% while transit revenues were down 72%. Jeremy Male said that company expects revenue to be down by 30 percent in the fourth quarter of 2020 but ridership and revenues will recover as a covid vaccine becomes available. The company’s earnings deck contained a slide which shows that weekday ridership is running at only 12-30% of normal levels in places where it has it’s transit plant.

- Operating expenses declined 37% during the third quarter of 2020 due to lower transit costs, posting and maintenance expense and billboard lease expense.

- Selling General and Administrative expense declined 23% due to lower compensation costs and professional fees.

- Cashflow declined 51% to $69 million for the third quarter 0f 2020 due to reduced revenues.

- The company has $691 of cash and $498 of availability under a revolving line of credit. The company also has $233 in unsold common stock under an equity offering program. Total debt is $2.7 billion. Leverage is 6.1:1.0 due to reduced cashflow.

- OUTFRONT added 41 digital billboards in the third quarter. Male stated that capital spending will increase next year: “We’re certainly looking to be ramping up our digital billboard investment…next year. A couple of hundred boards and capital expenses of $80 million…Why will we do that?…We’re still making great returns…We’ll also keep our eye out for tuck-in acquisitions…We’re looking at a couple now.”

Insider’s take: The numbers are headed in the right direction. The third quarter’s 39% revenue reduction is better than the second quarter’s 49% revenue reduction. OUTFRONT has the cash and liquidity to ride out things until ridership returns. OUTFRONT finished the day up 1.4% on a day when Lamar was up 2.8%, the S&P was up 2.2% and Clear Channel Outdoor was down 2.0%.

[wpforms id=”9787″]

Paid Advertisement