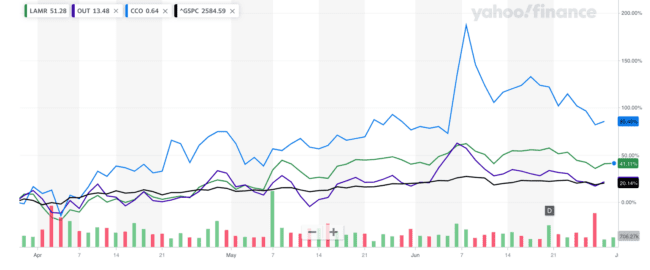

US out of home stocks had an outstanding quarter as traffic rebounded and the economy began to open back up from Covid closures.

Clear Channel Outdoor (blue), Lamar (green), OUTFRONT (purple) and S&P 500 (black) stock performance April-June, 2020

Clear Channel Outdoor increased 85% to $1.04 during the quarter versus a 20% gain for the S&P 500. The stock increased on the sale of the company’s money losing Chinese out of home joint venture in April 2020 and management expressions of a willingness to sell more assets to cut leverage.

Lamar increased 41% to $71.51 for the quarter. The market is bullish on Lamar’s management team and financial resources and expects Lamar’s rural freeway plant to respond fastest to an improving economy.

OUTFRONT was up 20% to $14.17 for the quarter. Outfront’s growth was in line with the 20% increase in the S&P 500. OUTFRONT lagged Lamar and Clear Channel because the market expects OUTFRONT’s transit and urban plant to take longer to recover from covid.

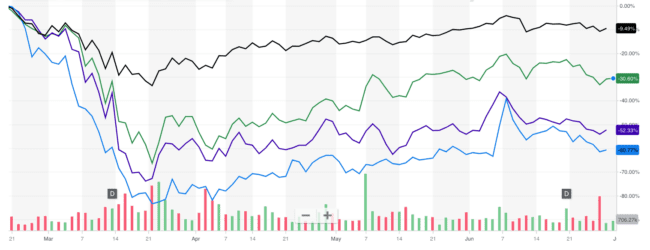

Out of home stocks are trading below their pre-covid highs which implies they have some upside when the economy returns to normal. Lamar is 30% below its pre-covid high. OUTFRONT is 52% below pre-covid high. Clear Channel Outdoor is 61% below pre-covid high. Here’s a chart showing how each company has done since February 20 just prior to the onset of covid.

[wpforms id=”9787″]

Paid Advertisement