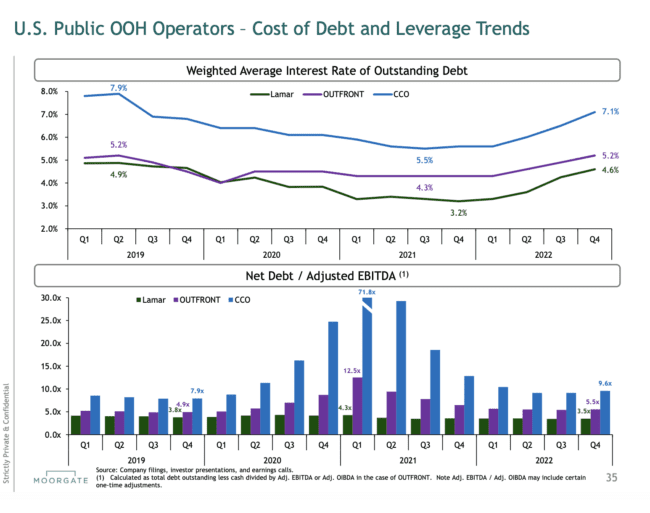

Moorgate Capital Partners has prepared a summary of out of home leverage and cost of debt trends thru December 2022. The cost of out of home debt has risen by 100-200 basis points over the last year due to Federal Reserve interest rate increases. Lamar has the lowest weighted average cost of debt at 4.6%. Clear Channel Outdoor has the highest cost of debt at 7.1%. Public out of home company leverage (net debt to adjusted ebidta) has been declining over the past two years as the out of home companies have shaken off the impact of covid. Lamar has the lowest leverage at 3.5 times. Clear Channel has the highest leverage at 9.6 times.

If you are interested in obtaining Moorgate’s Q3 OOH report contact Jeff Seddon, Vice President, Moorgate Capital Partners, jeff.seddon@moorgatepartners.com, 609-276-2508.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement