OUTFRONT had another good quarter. Here are the results from the Outfront 4Q 2019 earnings release , OUTFRONT 4Q 2019 investor presentation and conference call.

- Revenue increased 7.9% to $488 million with all sectors (national, local, transit and billboard) up. US billboard revenue was up 7.2%. US transit revenue was up 13.8%. CEO Jeremy Male said the company projects revenues in the mid-single digit range during 2020.

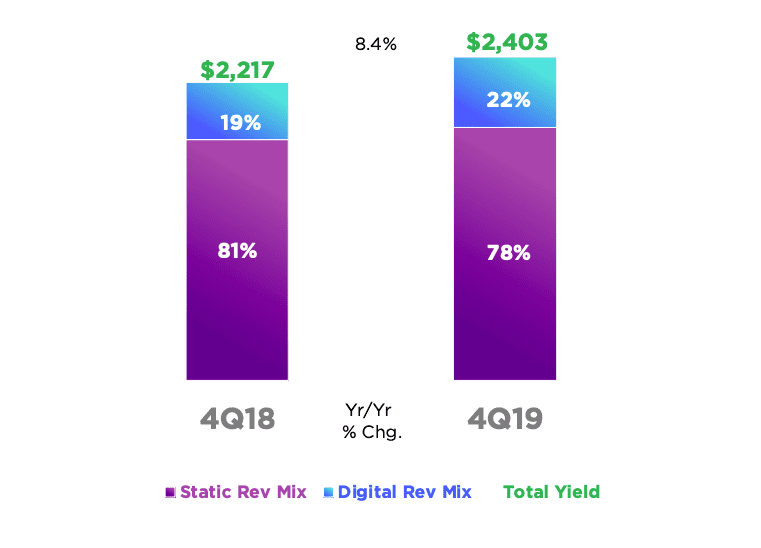

- The company’s US billboard yields increased by 8.4% to $2,402 during the fourth quarter of 2019.

OUTFRONT US Billboard Yields 4Q 2018 Versus 4Q 2019

- Expenses increased by 9% to $336.4 million during the fourth quarter of 2019. Billboard lease and transit franchise costs increased due to increased revenue. Corporate overhead increased by 4.9 million (50%) t0 $14.7 million during the fourth quarter due mainly to equity-linked compensation costs associated with a steep increase in the company’s stock during 2020.

- Cashflow (adjusted OBIDA) increased by 5% to $152 million.

- Capital expenditures totaled $25 million for the fourth quarter, consisting of $3.1 million of maintenance capital and $21.4 million of growth capital. The company’s MTA screens increased by 837 to 4,505 during the fourth quarter. The MTA contract calls for 50,000 screens. MTA deployment costs were $50 million for the quarter. They are not included in capital expenditures because they are accrued as a prepaid MTA deployment cost and are amortized against the MTA contract revenues.

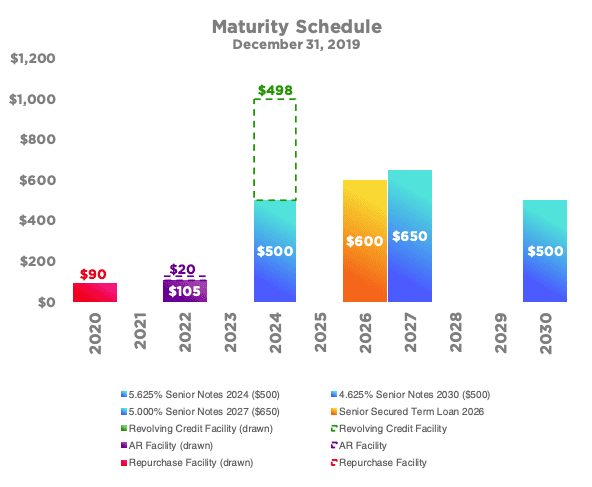

- Debt/Cashflow is a reasonable 4.5 times and most debt matures after 2023. The company has $577 million in liquidity (cash and undrawn lines of credit) and the ability to issue $277 million in equity. The weighted average cost of debt is 4.5%.

Insider’s take: Great revenue growth but OUTFRONT like Lamar is forecasting slower growth next quarter. OUTFRONT has $854 in liquidity and a stock issuance facility to fund $300 million in future MTA expenses and $100 million in annual capexp. About the only negative was that expenses grew faster than revenues due to increased lease, costs, transit franchise costs and corporate overhead.

[wpforms id=”9787″]

Paid Advertisement