Insider wrote last week about Clear Channel and their announcement of a “shareholder rights plan” . Seeking Alpha and Reuters followed up with pieces on valuation problems with some recent bond offerings. Since March 24, the day after the Fed announced its unprecedented stimulus programs, 23 companies borrowed money in the public market at a rate of 9% or higher. of the 23, three companies have been trading around 80 cents on the dollar, a reduction of 20 points from where they were originally issued. Clear Channel Outdoor is one of those three companies.

In March, the Fed announced a primary market facility to buy new high-grade corporate bonds and a secondary market facility to buy shares in exchange-traded funds. Both were later expanded to include some speculative debt. Its primary facility can buy bonds of companies that have a maturity of five years or less and are rated at least BBB-/Baa3 as of March 22, or if downgraded, must be at least BB-/Ba3. The Clear Channel debt is rated B- by S&P and B3 by Moody’s.

The Seeking Alpha article speculates the Fed buying programs may be causing a split between companies eligible for Fed bailouts – high-grade names – and speculative-grade companies unlikely to garner direct support.

Insider Take: We said last week that Clear Channels undervalued assets could make them a takeover target. Not sure if additional press coverage like this helps their cause. It could be an interesting year.

[wpforms id=”9787″]

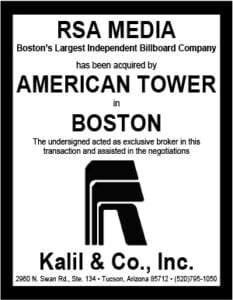

Paid Advertisement