Lamar announced 4th quarter and full year earnings yesterday. Here are the highlights from the earnings release and conference call.

Lamar announced 4th quarter and full year earnings yesterday. Here are the highlights from the earnings release and conference call.

- CEO Sean Reilly recapped the year:” 2019 was a solid year for Lamar as we successfully integrated the Fairway, Ashby Street and Mid-America acquisitions, adding nine new markets across the states of North and South Carolina, Georgia, Arkansas, Kansas, Illinois and Wisconsin to our nationwide footprint. Our top and bottom line growth came in largely as expected for the year and enabled us to finish near the top of our guidance for full year.”

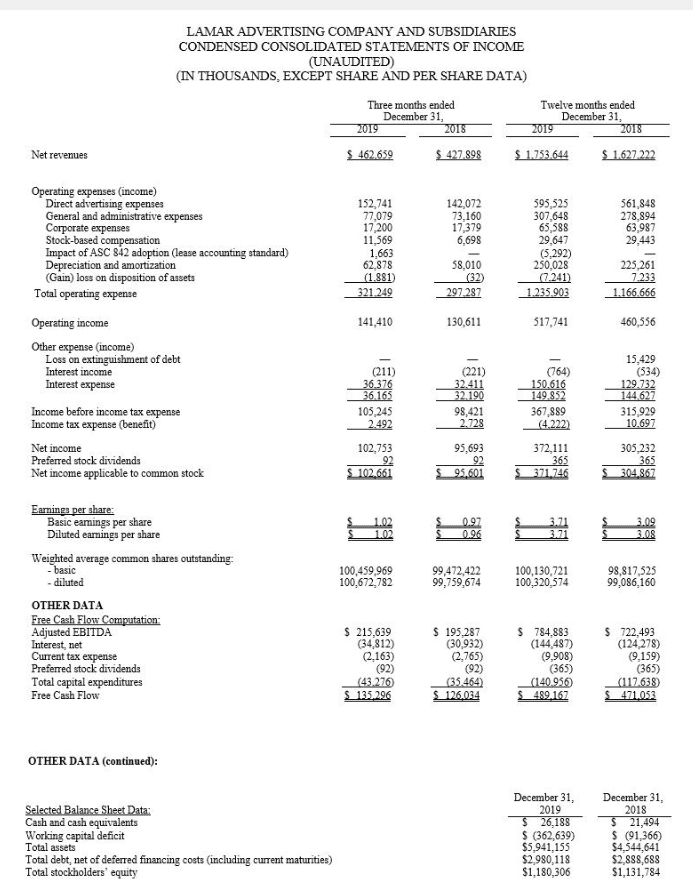

- Revenues increased 8% to $463 million during the fourth quarter. Acquisitions accounted for two-thirds of the revenue improvement and organic revenue growth accounted for one-third of the revenue improvement. Acquisition adjusted revenue grew 2.7%.

- Cashflow (adjusted EBIDTA) increased 10% to $216 million during the fourth quarter, due to the positive impact of acquisitions.

- Capital expenditures totaled $43 million for the quarter consisting of $30 million in growth capital and $13 million of maintenance. The company ended 2019 with 3,542 digital faces and intends to build an additional 250 new digital faces during 2020.

- Lamar ended 2019 with moderate Debt/Cashflow of 3.5.

- The company has $413 million of liquidity to fund acquisitions consisting of cash of $26 million and $387 of availability under a revolving line of credit. Reilly says the pace of acquisitions has fallen after spiking in 2019 with the Fairway, Mid-America and Ashby St transactions.

Insider’s take: Lamar consistently grows cashflow faster than revenues by holding down expense growth. You don’t always see this with the other public out of home companies. Lamar finished the day up 1% to $96.19 on a day when the S&P 500 declined 0.4%, OUTFRONT declined 0.6% and Clear Channel Outdoor declined 2.3%.

[wpforms id=”9787″]

Paid Advertisement