Lamar CEO Sean Reilly introduced Lamar’s 4Q 23 earnings release with a familiar script: “Revenue growth accelerated as we moved through the fourth quarter, primarily because of strength in local sales. In addition, our team continued to do an outstanding job controlling expenses…” Here are the results from Lamar’s 4Q 2024 earnings release and earnings call.

Lamar CEO Sean Reilly introduced Lamar’s 4Q 23 earnings release with a familiar script: “Revenue growth accelerated as we moved through the fourth quarter, primarily because of strength in local sales. In addition, our team continued to do an outstanding job controlling expenses…” Here are the results from Lamar’s 4Q 2024 earnings release and earnings call.

- Net revenue increased 3.8% to $556 million due to acquisitions and organic revenue growth of 2.5%. Local revenue was up 3.3%. National revenue was down 4%. Programmatic revenue was up 10%. Sean Reilly said the company expects to see revenue growth of 3-4% in the first quarter of 2024.

- Adjusted EBIDTA increased 6.3% to $268 million as Lamar kept expenses constant. Lamar achieved a company record EBIDTA margin of 46.7% for 4Q 2023.

- At 12/31/24 Lamar had $3.3 billion in debt with a weighted average cost of 5% and a weighted average maturity of 4.3 years. Debt/Cashflow is a moderate 3.1 times.

CEO Sean Reilly says Lamar is slowing digital conversions

We have added a lot of digital screens through acquisitions and internal conversions over the past several years and you will likely see a somewhat slower rollout in 2024 we are targeting somewhere between 200 and 250 organic additions this year rather than the roughly 300 that we deployed in 2023.

Sean Reilly says Lamar will make fewer acquisitions in 2024 but look out for 2025

We completed 36 acquisitions for a total purchase price of $139 million including $19 million worth of deals in Q4. We believe 2024 is likely to be a quieter year on the acquisition front than 2023 as there are fewer assets coming to market and there is often a bid ask spread…when I think about 2025 and beyond 2025…you’re gonna see consolidation accelerate…we’re prepping the balance sheet for what we believe will happen over the next let’s call it 18 to 36 months

CFO Jay Johnson says Lamar will pay down debt

We will pay down the debt this year…what that means is we could have an investment capacity of north of a billion dollars and not exceed the top end of our our leverage range.

Billboard Insider’s take: Lamar is clearing the debts for a major acquisition in 2025. Do Reilly and Johnson expect Clear Channel Outdoor or Adams asset spinoffs? Lamar will have $1 billion of investment capacity by 2025. That’s twice as high as the $458 million that Lamar paid for 5,500 Clear Channel Outdoor faces in 2016. Adams has 10,000 faces. You do the math. Lamar closed the day down 1.6% on a day when the S&P 500 say up 0.1%, Clear Channel Outdoor was up 5.0% and OUTFRONT was down 0.6%.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

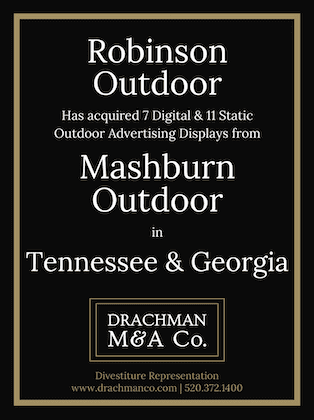

Paid Advertisement