Ken Altena has 35 years experience as a lender to out of home companies. He is a partner in Billboard Loans, LLC.

As a lender, I am often asked, “How much can I borrow?” The answer is, “it depends.” It depends on your borrowing costs and it depends on how quick a lender wants to be repaid.

Lenders focus on sustainable debt. Lenders want to get repaid in cash, principal and interest, on time, as scheduled. They want you to succeed. They do not want your collateral.

So what is sustainable? The debt that can be repaid monthly from recurring cash flow over a reasonable time frame. The monthly payment needs to include interest, so your interest rate will make a significant difference. Your payback/amortization period will have an even bigger impact. Leasing companies might want a 5 year payback. Banks and non-bank lenders want 7-10 year payback. Sustainable debt needs to be based on your current cashflow assuming no increases. You never want to have to rely on increased cashflow to avoid a default.

Recurring cash flow is what’s left after monthly operating expenses (leases, utilities, labor and office expenses) before interest, principal, income taxes, and non-cash expenses for the depreciation and amortization of your assets. This is often referred to as EBITDA (Earnings before interest, taxes, depreciation, and amortization.) Your EBITDA then needs to cover your monthly debt payments, income taxes, capital expenditures, and the owner’s compensation (if not included in costs of sales or operating expenses.)

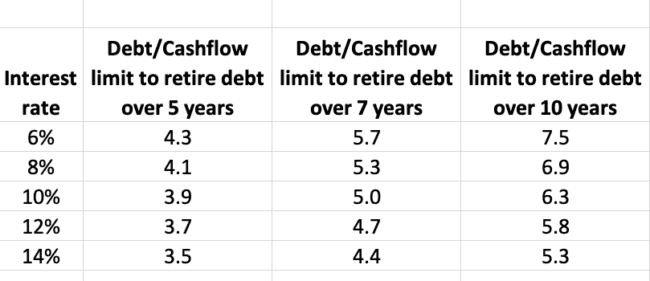

Here’s a breakdown of how much debt can be repaid over 5-10 years assuming no increase in your cashflow at different interest rates.

Any lender will tell you using 100% of your EBITDA is not sustainable because you still have to pay taxes and generate funds for future capital expenditures and for the owners. You also need a cushion in case cashflow drops in a recession. For these reasons it makes sense to borrow a turn less than what the chart tells you.

So what’s the takeaway? Sustainable debt is 4-6 times cashflow.

You can contact Ken Altena at 206-636-8478 or by emailing Kenaltena@billboardloans.com

[wpforms id=”9787″]

Paid Advertisement