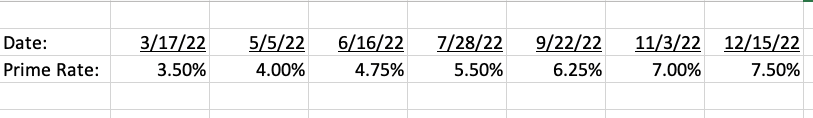

The Fed raised interest rates another half percent yesterday to combat inflation. The prime rate, which is the lending index for most private out of home companies, has more than doubled over the past year as you can see below.

The Federal Reserve signaled yesterday that there may be one more rate increase coming. The Fed wants to see inflation decline from the current 6-8% level down to 2% before easing rates.

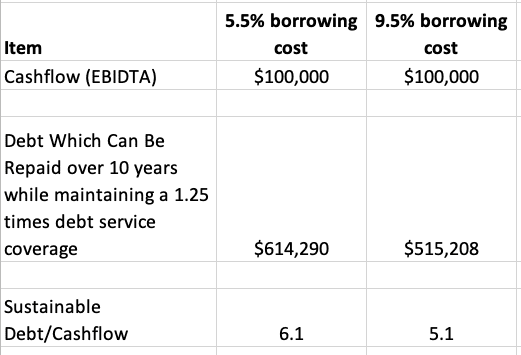

The increase in rates has reduced sustainable debt for out of home companies by about 1 times cashflow. Let’s assume your out of home company has cashflow (ebidta) of $100,000 and that your lender wants you to repay all your debt over 10 years while maintaining a 1.25 times debt service coverage. The rise in rates has reduced your sustainable debt from 6.1 times cashflow to 5.1 times cashflow as you can see below.

Billboard Insider’s take: You’ll need to be ready to put more equity into acquisitions and capital expenditures or you’ll need to reduce what you pay for out of home assets for the next year or two until interest rates ease. The public out of home companies are a little more sheltered from interest rate rises because a portion of their interest rate is fixed. We’ll write more about this next week.

[wpforms id=”9787″]

Paid Advertisement