“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

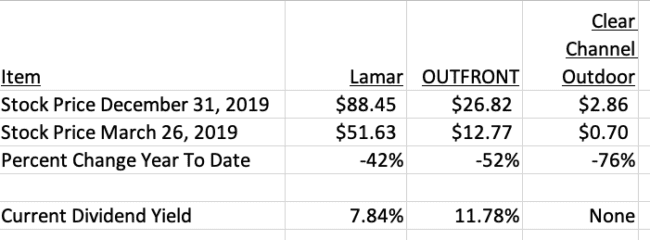

Public out of home stocks have rallied this week but are down dramatically year-to-date. Here’s the data.

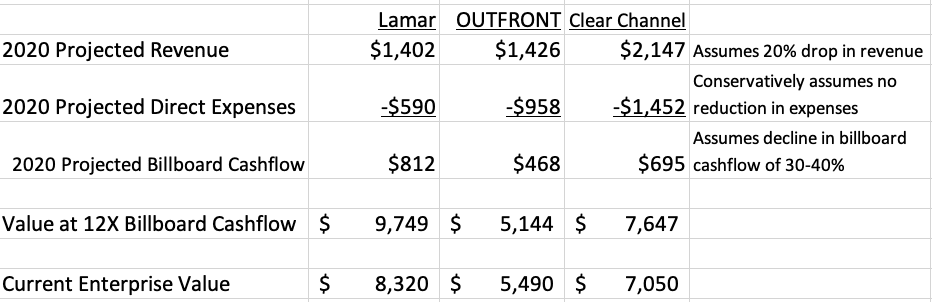

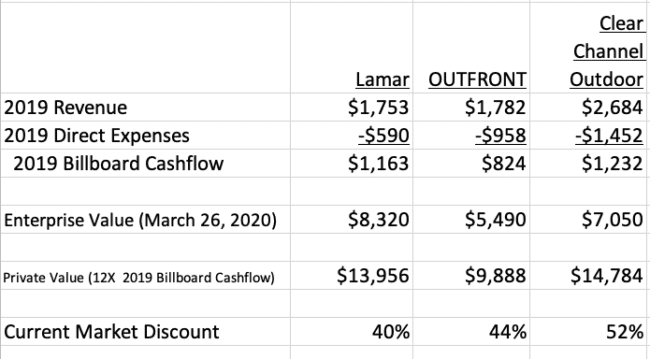

Looks to Insider like the market has priced a 20% revenue decline and a 30-40% cashflow decline into the public out of home stocks. See this comparison of each company’s private valuation at 12x projected 2020 billboard cashflow versus current enterprise value (the value of each company’s stock and liabilities). Insider doesn’t expect public company cashflows and revenue to drop this much but the market does.

If you think that the coronavirus disruption is a temporary event and revenues will eventually return to 2019 levels then you should buy the US out of home companies because they are undervalued by 40-50%.

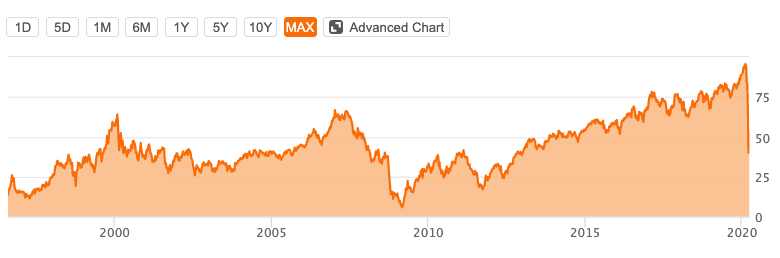

Insider bought Lamar and OUTFRONT during last week’s panic and is sitting on a tidy gain. Insider has his eye on the long term and doesn’t expect to sell for several years. The economy will recover and when it does out of home stocks will rise dramatically. Look how Lamar stock has performed since 1996. Out of home recovered from 9/11. Out of home recovered from the great recession. Out of home will recover from coronavirus.

Lamar Advertising Stock Performance 1996-2020

Here’s what Warren Buffett thinks: coronavirus is “scary stuff” but Buffett remains optimistic about long-term prospects and investors shouldn’t get too caught up in today’s headlines. Buffett’s buying stocks.

[wpforms id=”9787″]

Paid Advertisement