Ian Dallimore, Vice President of Digital Growth & GM of Programmatic, hosts the Lamar produced podcast Digital & Dirt. If you have not yet checked it out, it is worth the listen. Most recently, Ian had a fascinating conversation with Charlie Lamar, Former General Counsel and Board Member for Lamar Advertising.

One segment that caught our attention was a reminder that Lamar has not always been the large, publicly traded REIT, with easy access to the equity and debt markets to spur their continued growth. They actually grew their early business in creative and familiar ways. Here is the exchange, and do check out the entire podcast at Digital & Dirt.

Ian: What a brilliant and very gutsy move at the time. It’s not like money is readily available just to be passed off to purchase companies. Today there’s a lot of liquidity …. When we go to banks it’s a bit different conversation now, obviously, than it was in the 50s 60s ….. you’re getting deals by buying these mom and pop companies, but … on the Lamar side, it was a gamble as well because we didn’t know how this would all turn out.

Charlie: We did not get a bank loan until, probably, 1983 or 84. So back in those days in the fifties, sixties and seventies the big banks would not lend money to us… We have great stories of of Kevin swinging into a town like Fort Myers, Florida and there’s a little company there and schmoozing with the owners there who are thinking about getting out. The big part of that is not only did they have to come to terms with the sale, but he had to talk with families into seller-financing for the company. So basically we would put together some local investors in front of the family and some local business people, who became eventually our board members, for a down payment. Who paid maybe 20% down and 80% of it was owner financed. But the people knew the business, they knew us and the business and so you know he was able to buy I don’t know how many 5/10/15 companies along the way before we got into the bank financing wedges.

Ian: So holding hands and kissing babies and maybe pay for a steak dinner.

Charlie: Yeah, the banks didn’t understand the business. So they saw on the books that we never made money, because on the books we never made money because billboards are depreciated over a short period of time. We all know billboards last a very long time. So as long as you kept buying new companies with new depreciation, our depreciation was greater than our net revenue. So even though our cash flow was tremendous, the banks just didn’t understand it.

Apparently, the banks understand it now….

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

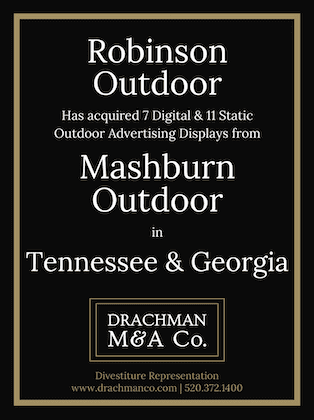

Paid Advertisement