By Kerry Yoakum (OAAA)

By Kerry Yoakum (OAAA)

One out of three states could consider proposals this year to tax services traditionally exempt from sales taxes (advertising is a service).

Several factors are driving this trend:

- Some states face budget stress

- The service sector is a growing part of the economy

- Politically, taxing services could seem preferable to taxing income or profits, or cutting services

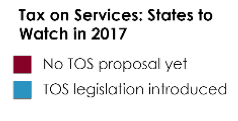

As state legislatures convene, proposals to tax services could be considered in 17 states (Alabama, Arizona, California, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Ohio, Nebraska, Oklahoma, Pennsylvania, South Carolina, and West Virginia).

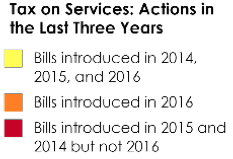

Some States — including California, Illinois, and Pennsylvania — have considered legislative proposals to tax services in consecutive years.

OAAA works with a coalition of advertising groups (the ad agencies, ad clubs, and the national advertisers) to oppose services taxes on advertising. OAAA members can access the following resources:

Those who follow tax issues recall that Florida enacted a tax on services in 1987, including advertising. The negative response prompted then-Governor Bob Martinez to call the legislature back to repeal the services tax two months after it went into effect. Opposition from media and advertisers was intense.

Martinez sought re-election in 1990; he lost.

Florida’s sales tax rate is 6 percent (with local surtaxes the average is 6.65%).

After repeal of the services tax in Florida, The New York Times published this analysis on December 24, 1987:

Florida’s repeal of its tax on personal and professional services is having an impact on states that monitored the progress of the tax, from enactment with broad bipartisan support last spring to crushing defeat earlier this month. Repeal and the political bloodletting that accompanied it have caused leaders in a half-dozen or so states that were contemplating similar legislation to back away from a fight with powerful national advertising and media forces. The outcry from those forces led to the defeat of the Florida tax.

The print and electronic media contended that the tax was an infringement on the right of free speech, would harm commerce and would establish a precedent for other states. Florida applied the tax to all advertising distributed in Florida, including national broadcasters and magazines whose headquarters are not in Florida, and also to some services of out-of-state architects, lawyers and accountants.

Kerry Yoakum (kyoakum@oaaa.org) is Vice President of Government Affairs at the Outdoor Advertising Association of America

[wpforms id=”9787″]

Paid Advertisement