Daktronics announced at the end of last week, they had closed on a 3 year $75 million senior secured credit facility with JP Morgan Chase. This is great news for the Company as it will replace and enhance a $35 million credit facility they had with U.S. Bank. In their press release, Howard Atkins, Chair of the Daktronics Board’s Strategy and Financing Review Committee shared:

“We are pleased to have delivered on our commitment to identify attractive financing for the Company, which was the result of a comprehensive process. The Committee is confident we and our advisors thoroughly explored all alternatives and obtained the best possible outcome in terms of flexibility and overall cost of capital.”

But the Senior Credit Facility was only part of the announcement. The eye-opener to Insider was the announcement that they had also closed on a a $25 million senior second lien secured convertible debt financing agreement with major shareholder Alta Fox Capital Management, LLC. For our readers who remember, Alta Fox, led by Connor Haley was a source of major concern to Daktronics earlier this year. Haley openly expressed his concern about Daktronics and the effectiveness of the management team back in January. But since then, a several positive things have happened as the Management team worked hard at getting their large order backlog turned into completed projects and as Jeremy Johnson explained in April that they Company has made some major strides in improving their supply chain.

The facility between the two Companies creates a relationship that extends to May 2027. The Notes can be converted into common stock at any time by Alta Fox, subject to certain conditions, at a conversion price equal to $6.31. Daktronics also has the right to convert the same notes into common stock, after 18 months following the issuance date, if the closing sale price of the Company’s common stock has been equal to at least 150% of the conversion price in 19 of the last 20 consecutive trading days.

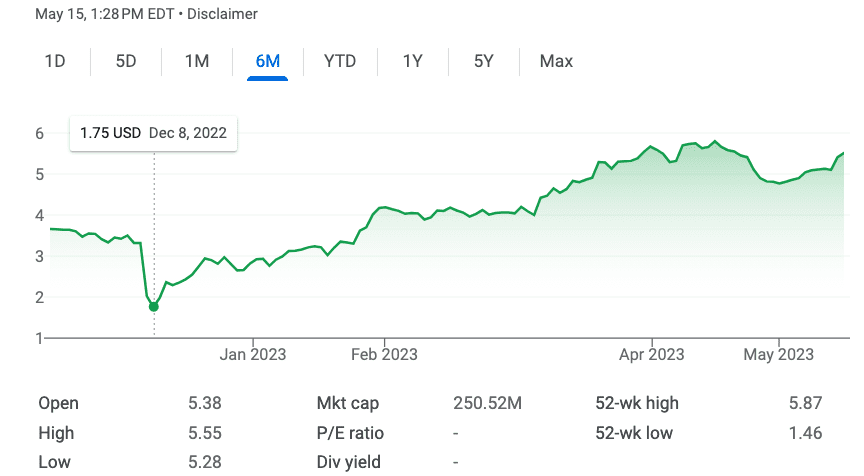

As a result, Daktronics’ third quarter results, released in early March were much improved and their stock has responded accordingly with their share price climbing from a $1.75 on December 8th to $5.46 at the end of close yesterday (see the chart below).

Daktronics CEO, Reese Kurtenbach, summed it up in the press release:

“Daktronics continues to make positive progress on several fronts. In addition to the financial flexibility these new sources of capital provide, the management team continues to implement operational and productivity improvement initiatives intended to increase the Company’s profit margins and generate additional cash from operations. We appreciate and are looking forward to developing our new primary banking relationship with JPMorgan Chase, a leading financial services firm with unmatched global capabilities and deep expertise in corporate finance. We also appreciate that Alta Fox has demonstrated its confidence in Daktronics’ path forward by committing additional capital to the Company. Alta Fox has been a collaborative partner and we thank them for their support.”

Insiders’ Take: First, congratulations to Daktronics as they have performed remarkably well over the last 6 months. This deal is a win for everyone (except maybe US Bank). Chase Bank picks up a new customer. Daktronics turns a key investor into an ally, and Alta Fox looks like they are headed to the types of returns they had planned for when they made their investment into Daktronics.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement