Here are highlights on Daktronics forth quarter results.

- Q4 sales decline of 1.3% year to year to $126.1M, reflecting fluctuations in the timing of order bookings, and related conversion to sales, including some shipping and onsite delays caused by COVID-19; and orders declined by 9.4% Y/Y.

- Sales by segments: Commercial which includes billboards $32.06M (-8.5% Y/Y); Live Events $37.39M (+2.8% Y/Y); High School Park and Recreation $20.98M (+25.7% Y/Y); Transportation $16.88M (+22.6% Y/Y); and International $18.79M (-27.4% Y/Y).

- Q4 Gross margin to 22.7%.

- Operating loss reduced to $3.45M, from $10.26M last year same quarter.

- Net cash provided by operating activities for the fiscal was $10.81M, compared to $29.55M a year ago. Free cash flow was negative $6.96M.

- Company had cash, restricted cash, and marketable securities at the end of Q4 of $41.6M; and $15M borrowed on line of credit.

For the fiscal year the Company reported:

- Net sales for fiscal year 2020 of $608.9 million versus $569.7 in fiscal 2019

- Operating loss in 2020 of $0.2 million versus $4.7 million in 2019

- Net income in fiscal 2020 of $.5 million versus $1 million in 2019

- Fiscal 2020 orders were $620.8 million compared to $608.9 million for fiscal 2019.

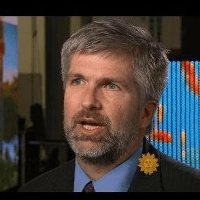

Daktronics CEO Reece Kurtenbach shared the following.

“As we entered into fiscal 2020, we focused on winning more orders through existing and new markets and sales channels, developing and deploying newly designed solutions and advanced manufacturing techniques, and managing capacity and spend. We achieved these goals. Our investments in technology yielded additional features in our control systems and broadened our lineup of displays which contributed to the second highest level of order volume in our company’s history…. Significant projects for fiscal 2020 included Texas Rangers where we provided a complete audiovisual control solution throughout the park and at the San Jose Airport where we provided displays for the nation’s first all-digital airport advertising network.”

“To support our long-term technology advancement strategies, we participated in a Series A investment in X Display Company (“XDC”). XDC creates and owns leading intellectual property and capabilities in microLED mass transfer technology. This investment supports our line of narrow pixel pitch LED displays and will enable solutions to move into the realm of less than 1-millmeter pixel spacing.”

“In March 2020, the World Health Organization declared the outbreak of COVID-19 a global pandemic, and in the following weeks, many countries and U.S. states and localities issued lock down orders impacting businesses globally. Like many other companies, the pandemic and related social reactions have impacted our business and have created an unprecedented and challenging time. Our growth-oriented focus of investing in the development of sales channels and new products for long-term success has turned to reacting to the new near-term realities of this uncertain business environment. We have taken actions to reduce costs and to focus on key priorities to position ourselves for a strong recovery when the crisis is over. However, the ensuing depth and length of impact to the economy and our customers reactions to the environment create uncertainties predicting fiscal 2021 opportunities.”

“The market’s increasing adoption and use of digital solutions, along with our new technology releases, cause us to remain positive on the overall future of our business and growth in the industry.”

Insider’s Take: The market responded positively trading up 4.6% for the day.

[wpforms id=”9787″]

Paid Advertisement