“We’re off to a good start and believe 2023 will be a positive year for the business, despite some uncertainties regarding the macro environment,” said Clear Channel CEO Scott Wells yesterday. Here are the results of the Clear Channel Outdoor 4Q 2022 earnings release, 4Q 2022 earnings presentation and conference call.

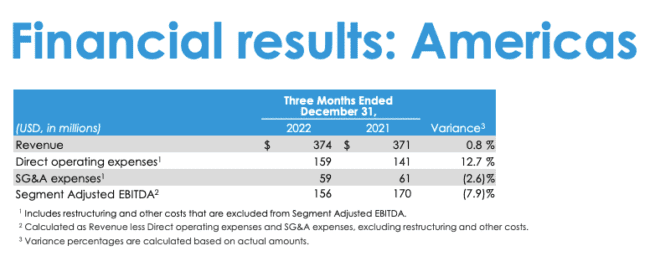

- Consolidated revenue declined by 4.5% to $709 million in the fourth quarter of 2022 due to adverse foreign exchange movements. Consolidated revenue was up o.9% to $750 excluding FX movements. Americas revenue was up 0.8%. Airport and digital revenue increases were offset by a decline in printed billboard revenue. Europe revenue was up 2.1% excluding foreign exchange movements. Here are the results of the company’s Americas segment.

- Adjusted EBITDA declined 4% to $214 million excluding FX movements during the fourth quarter of 2022. The decline was due to the end of covid rent abatements.

- Clear Channel had $5.6 billion of debt at December 31, 2023 with a weighted average cost of debt of 7.1%. Debt/Cashflow was a high 9.9 times. Clear Channel does not expect the sale of European assets to deleverage the balance sheet.

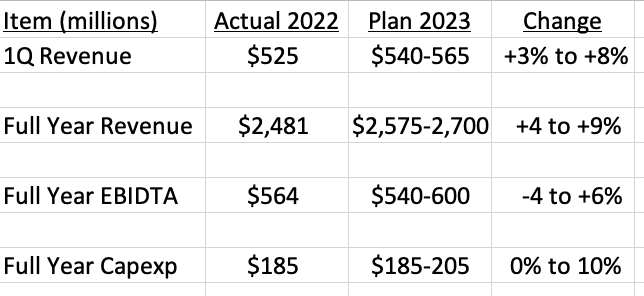

- Clear Channel projects consolidated revenues will grow in the high single digits in 2023. EBIDTA could decline slightly due to covid rent abatements falling away as well as the fact that a major US contract has been renegotiated. Capexp will be flat to slightly up.

Clear Channel CEO Scott Wells says the company’s Switzerland sale remains on track

At the close of the year, we announced the definitive agreement to sell our business in Switzerland for $92.7 million, which remains subject to previously disclosed closing conditions. We intend to use the anticipated net proceeds to improve our liquidity position, while our strategic review of our low margin and low priority European businesses remains ongoing.

Wells says Clear Channel wants to increase ad rates.

We absolutely saw a strong rate environment, and frankly continue to see a good rate environment…. It’s not as simple as just inflation, but that certainly makes it a little bit easier of a conversation…There’s a lot of segmentation of our assets in terms of location, and it has been a very premium market in terms of advertisers looking for the very, very best locations, and that creates a rate. So, I guess what I’d tell you is that we are very focused on rate…And we expect that we will continue to be able to drive yield in 2023.

CFO Brian Coleman says Clear Channel is being selective with acquisitions

I also want to highlight that during the quarter, we did continue to close a few more asset acquisitions in the US totaling $10 million. Given our renewed focus on liquidity amid the current macro uncertainty, we are being more selective in our acquisitions.

Billboard Insider: The market liked the news. Clear Channel Outdoor stock increased 14% on a day when Lamar grew 0.8%, OUTFRONT fell 1% and the S&P 500 fell 0.3%.

To receive a free morning newsletter with every Billboard insider article, email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement