Better than JCDecaux but worse than OUTFRONT or Lamar or Link Media was how you could summarize Clear Channel Outdoor’s second quarter 2020. Here are the results from the second quarter 2020 earnings release.

Better than JCDecaux but worse than OUTFRONT or Lamar or Link Media was how you could summarize Clear Channel Outdoor’s second quarter 2020. Here are the results from the second quarter 2020 earnings release.

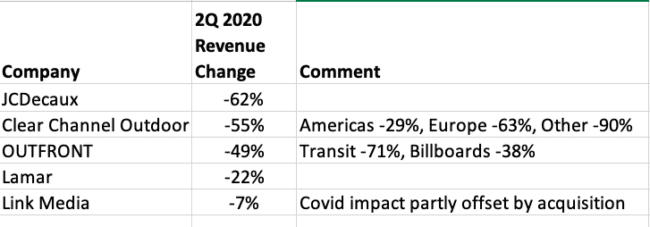

- Consolidated revenue declined 55% to $315 million during the second quarter of 2020. Americas was down 29%. Europe was down 63%. Other revenue was down 90% due to the sale of the Clear Media business in China. Here’s how Clear Channel Outdoor’s revenue decline compares to the other public out of home companies.

- Adjusted Cashflow (EBIDTA) was a negative $63 million for the second quarter of 2020 down from $180 million for the second quarter of 2019.

- Capital expenditures dropped in half to $24 million for the second quarter of 2020. The company deployed 19 new digital billboards in the Americas during the second quarter bringing total digital billboards to 1,400 in the Americas at June 30, 2020.

- Cash totaled $662 million at June 2020. Cash interest expense is projected at $162 million for the second half of 2020.

Insider’s take: No defaults in the works for Clear Channel as there’s enough cash on hand to pay two year’s worth of cash interest expense. Insider expects to see the company sell assets once the COVID overhang clears in order to reduce debt. Clear Channel’s leverage is almost twice as high as Lamar or OUTFRONT.

The market was disappointed. Clear Channel Outdoor was down 6% Friday. The S&P 500 was up 0.06%, Lamar was down 1% and OUTFRONT was up 3%.

[wpforms id=”9787″]

Paid Advertisement