Airports recovering. Billboards and northern Europe ho-hum. Southern Europe underperforming and on the way out. That’s how you can summarize the results of Clear Channel Outdoor’s 2Q 2023 earnings release, 2Q 2023 investor deck and conference call.

- Consolidated revenue declined by 1% to $637 million due to reductions in the company’s Europe south business associated with asset sales and dispositions. Organic revenue, however, grew 3.5% excluding FX movements and sold businesses in Europe south. America revenue was up 0.9%. Airports rebounded strongly up 16%. Europe North was up 3%.

- Consolidated cashflow (EBIDTA) declined by 11% to $146 million due to asset sales and increased operating and corporate overhead.

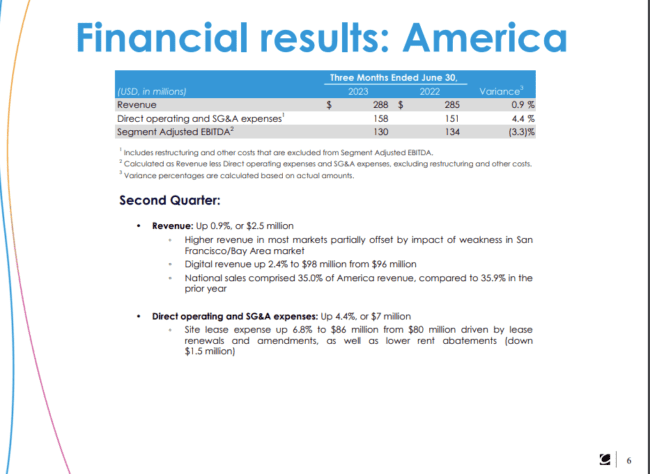

- Here are the results of Clear Channel’s America segment. Cashflow declined by 3.3% due to increased site lease expense as sell as lower rent abatements.

- Capital expenditures totaled $37 million during the second quarter of 2023, down from $45 million in the second quarter or 2022. Clear Channel Outdoor CFO Brian Coleman said the company is reigning in capexp based on current financial uncertainties.

- Clear Channel Outdoor ended the quarter with $5.6 billion of debt. The company has a weighted average cost of debt of 7.4%. The company had $130 million of cash interest expense during the quarter versus $146 million of cashflow.

CEO Scott Wells on asset sales

…we closed on the sale of Italy on may 31st and we expect to close on the sale of Spain in 2024 upon satisfaction of regulatory approval and other customary closing conditions, We also entered into exclusive discussions to sell our business in France and are aiming to complete the proposed transaction in Q 4/20/23 subject to an information and consultation process with Clear Channel France employee works council… we expect the sales of our businesses in Switzerland Italy as well as the anticipated sale of our business in Spain will generate approximately $175 million in gross total proceeds

Billboard Insider’s take: Weak US billboard numbers. Stubbornly high expenses. Interest expense equals 89% of cashflow (EBIDTA). Don’t expect Clear Channel Outdoor to spend big on capexp or make acquisitions while these conditions persist. Wells and Coleman hinted that corp expense cuts may be on the way. This is a must. Clear Channel Outdoor declined 3.6% on a day when Lamar increased 0.9%, OUTFRONT declined by 0.08% and the S&P 500 grew 0.9%.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement