“The exceptional results we delivered…primarily in the Americas have been offset by impact of the continued weakness in China’s consumer economy on Clear Media, with their revenues down 20% in 2019.” That’s how Clear Channel Outdoor Worldwide CEO William Eccleshare summarized 4Q 2019 financials. Here are the highlights of Clear Channel Outdoor’s earnings release , investor presentation and earnings call.

“The exceptional results we delivered…primarily in the Americas have been offset by impact of the continued weakness in China’s consumer economy on Clear Media, with their revenues down 20% in 2019.” That’s how Clear Channel Outdoor Worldwide CEO William Eccleshare summarized 4Q 2019 financials. Here are the highlights of Clear Channel Outdoor’s earnings release , investor presentation and earnings call.

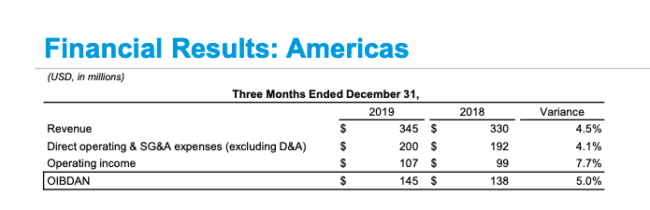

- Consolidated revenue declined by 0.3% to $745 million as lower sales in China offset increased sales in North America. Revenue was up 1% when adjusting for FX movements. You can see from the table below that Clear Channel Americas had a good but not great quarter. The 4.5% revenue increase trailed Lamar (8%) and OUTFRONT (8%) and was slightly ahead of 4% US GDP growth.

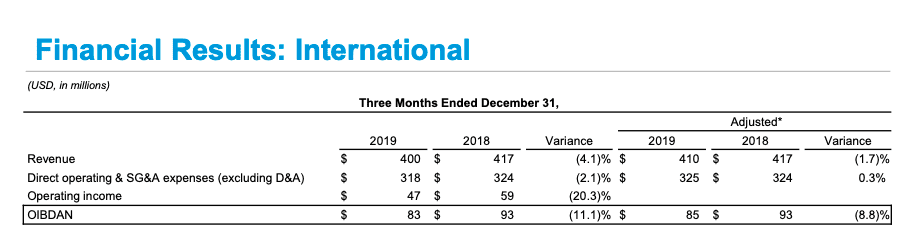

- International performance tells a different picture with revenue and cashflow down 4% and 11% respectively. China revenues were down $14 million or 20% in the fourth quarter and Eccleshare said he expects coronavirus to negatively impact China revenues in 2020. International lease costs are fixed so a decline in revenues has a multiplying negative effect on cashflow.

- Consolidated Cashflow (OIBDAN) declined by 0.1% to $192 million. Cashflow was up 0.7% when adjusted for FX.

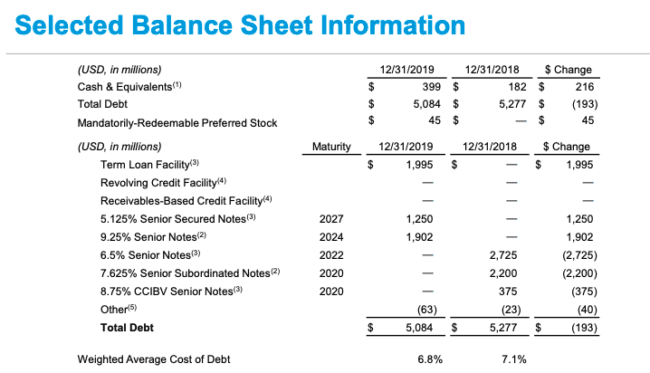

- Clear Channel Outdoor has $5.1 billion in debt with a weighted average borrowing cost of 6.8%. There are no significant maturities until 2024. Debt/Cashflow is a high 6.62. Insider think the sustainable level of Debt/Cashflow for an out of home company is 5.0.

- Capital expenditures totaled $232 million during 2019 and is projected at $200 million during 2020.

- Eccleshare signaled an increased willingness to sell assets: “Clear Media has already disclosed that we have initiated a strategic review of our investment in China and are continuing discussions with a potential purchaser. As of today, no decision has been made and no definitive decision has been entered into. But in addition to that to further improve our capital structure, pay down debt and unlock shareholder value we will actively evaluate additional opportunities including potential dispositions…Our focus is on taking the necessary steps to de-lever our balance sheet, enhance our financial flexibility and invest in technology to drive growth in our high margin markets particularly in the United States.” When an analyst on the call suggested that this was a stronger statement than Eccleshare had made previously, Eccleshare responded “I think your interpretation is a fair one.”

Insider’s take: Yesterday’s call showed an increased willingness to sell assets to reduce debt. The market liked what it heard. Clear Channel stock finished up 8.3% to $2.21 on a day when the S&P 500 declined 1%, Lamar grew 0.2% and OUTFRONT declined 2.1%.

[wpforms id=”9787″]

Paid Advertisement