A team of Clear Channel Outdoor execs provided a detailed review of Clear Channel Outdoor’s operations and strategy at last week’s Clear Channel Outdoor Investor Day. Here are the financial highlights from the investor day press release, investor day powerpoint and 2.5 hour investor day livestream. We’ll review the operating, sales and programmatic aspects of the talk over the next week.

CEO Scott Wells says Clear Channel Outdoor won’t sell US assets and will be a selective buyer

“We really have no intention of selling assets in the United States…You will see us active in the M&A markets as an acquirer..In a very good M&A market in the US we are not acquiring as much as our competitors. We are very realistic about our balance sheet. Most markets where we operate have a variety of independents who could be an attractive tuckin opportunity for us…we’re not going to go crazy on the acquisitions front.”

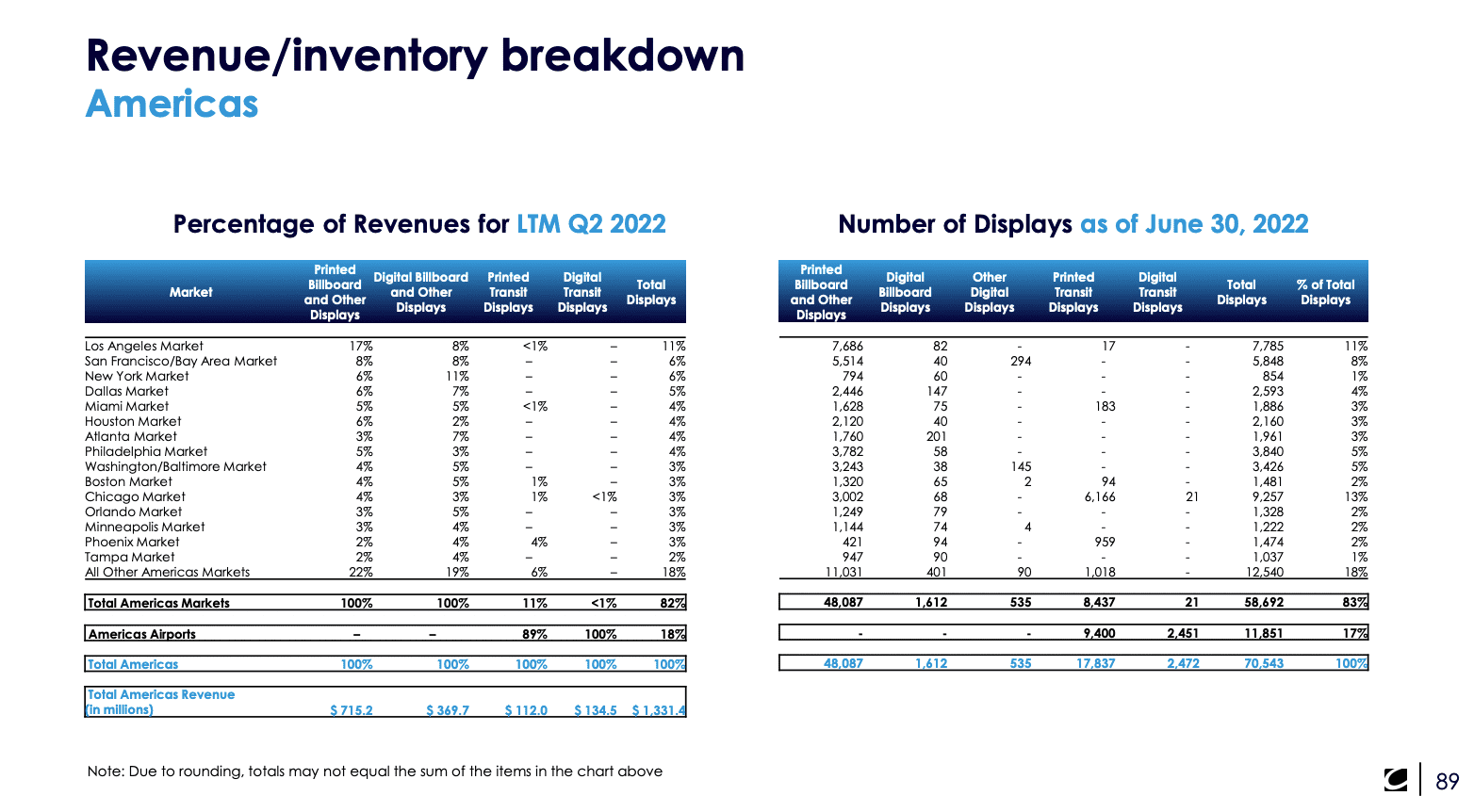

CFO Brian Coleman says Clear Channel Outdoor will disclose more.

“We’ll focus on what many of you have been asking for. Expanded disclosure, enhanced guidance and a long term outlook…Today we’re going a step further and providing revenue and inventory information for our top 15 markets. Going forward we’ll provide this table each year…”

Growing revenues and cashflow.

CFO Brian Coleman said Clear Channel Outdoor expects to see 4-6% average revenue growth and 7-10% average EBIDTA growth from 2022-2025. This is the first time the company has provided multiyear guidance. The multiyear forecast assumes no recession. Coleman said the company “is not seeing any softening in our business.”

Billboard Insider’s Take: Kudos to Clear Channel for committing to additional disclosure. Clear Channel Outdoor seems to be staging itself to become a REIT. It will start reporting AFFO just like a REIT. CFO Brian Coleman says that Debt/Cashflow needs to come down to 5-6 times EBIDTA for REIT status to become feasible. Billboard Insider doesn’t see this happening in the next three years unless there are European asset sales. Let’s take the most generous forecast. Clear Channel 2022 EBIDTA is $590 million (the high end of guidance). It grows by 10%/year (the high end of guidance) to $785 million at the end of 3 years. Debt today is $5.5 billion. That means debt/cashflow will be 7.1 at the end of 3 years. Still too high for a REIT, and too high to be sustainable in Billboard Insider’s mind.

[wpforms id=”9787″]

Paid Advertisement