Clear Channel issued a press release confirming details on a new term loan debt facility through their wholly owned subsidiary, Clear Channel International B.V. (“CCIBV”). CCIBV closed on the agreement on March 22nd with J.P. Morgan Chase Bank as the agent on the loan facility. Proceeds of the CCIBV Term Loan Facility, together with cash on-hand, was used to redeem all of the Companies outstanding senior secured notes, due 2025 with an aggregate principal amount of $375.0 million, and to pay certain related transaction fees and expenses.

The new term facility is comprised of two tranches of term loans, totaling an aggregate principal amount of $375.0 million. The first piece is a “fixed rate” tranche of term loans in an aggregate principal amount of $300.0 million , bearing interest at a fixed rate of 7.5% per annum. The second is a “floating rate” tranche of term loans in an aggregate principal amount of $75.0 million, bearing interest at a floating rate equal to the benchmark rate plus 2.25% per annum (subject to a floor rate of 5.25% per annum). The CCIBV Term Loan Facility matures on April 1, 2027 (the “Maturity Date”) and has no scheduled amortization payments prior to the Maturity Date.

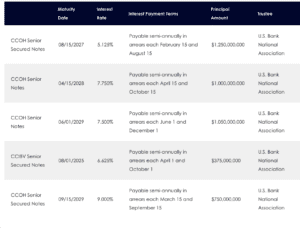

Insider’s Take: Prior to this announcement, here is what Clear Channels full debt package looked like:

If you focus on the CCIBV Senior Secured Notes, in the table above, the impact of the new debt becomes apparent:

- CCO has been able to push the maturity on the same amount of debt, $375 million, from August 2025 to April 2027.

- The cost of extending the maturity (which is a good thing) in an expensive credit market is a 1.25% increase in their fixed rate on $300 million.

- $75 million was converted to a floating rate of 2.25% over the benchmark rate (the Fed benchmark is currently 5.25%) which initially would price both debt tranches at 7.5%, again a 1.25% increase at today’s rates.

- You might have also noticed that to fully repay the CCIBV debt.

Clear Channel needed to extend out the maturities on the CCIBV debt tranche , as waiting for possibly better interest rates would have caused additional insecurity to investors, probably driving down the stock price. It will mean overall higher interest costs and a reduction in liquidity. We won’t be surprised to see Clear Channel continue to sell assets in Europe, South America and even North America.

As for the stock market, shares of CCO were relatively unchanged on a day when the market was down slightly.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement