Insider is a fan of Brad Thomas, a research analyst who writes on public REITs for Forbes and Seeking Alpha. Last week Thomas suggested that Landmark Infrastructure’s valuation imputes no value to the company’s portfolio of out of home leases. Insider thinks that Landmark should sell the portfolio to out of home companies to unlock the value for shareholders. Landmark is deemphasizing out of home lease and easement purchases so a divestiture would allow management to focus on the development of wireless outdoor and smart cities infrastructure. You can read Thomas’s entire article here. We’ve reprinted some excerpts with Thomas’s permission

We’ve been covering Landmark Infrastructure (LMRK) for just more than three years now. In my first article from July 2017, I explained:

“The properties are difficult to replicate, with significant zoning, permitting, and regulatory hurdles in finding suitable new locations, including the time and cost of construction at a new site. Vacating tenants must often return the property to its original condition.”

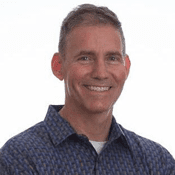

Keep in mind that Landmark’s business model is primarily focused on communications infrastructure through three operationally critical assets:

- Wireless (through highly interconnected networks with growing capacity/coverage)

- Billboards (in key traffic locations with favorable zoning restrictions and “grandfather clauses”)

- Renewables (in solar/wind corridors with proximity to transmission interconnects)

It’s important to recognize that Landmark is a master limited partnership that moved its partnership’s assets under a subsidiary that’s intended to be taxed as a real estate investment trust.

Landmark has been hammered, down 44% year-to-date compared with these indirect peers:

- Outfront (OUT), down 42% (billboards)

- American Tower (AMT), up 5.8% (tower)

- Hannon Armstrong (HASI), up 34% (utility)

Landmark is clearly trading like Outfront, which means Mr. Market isn’t accounting for its tower and utility portfolio much at all. That warrants a discussion about its valuation and whether we’ve got a worthwhile opening on our hands.

Let’s Start with the Outdoor Advertising Segment

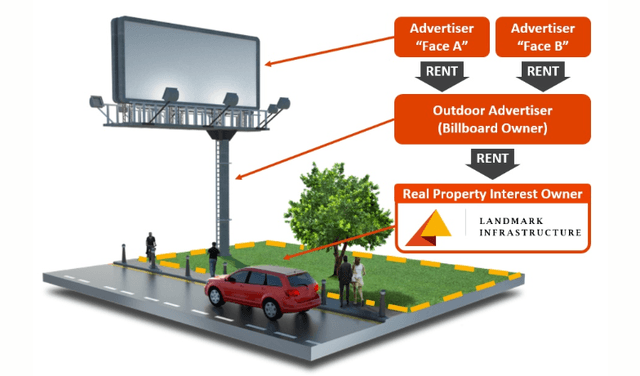

This June, Landmark sold its European Outdoor Advertising Portfolio to an undisclosed party for £95 million ($120 million). Here are a few facts about the transaction:

- The portfolio consisted of 742 available tenant sites that were 97% occupied.

- They brought in rental revenue of $1.541 million in Q2-20, or an annualized $6.2 million.

- Landmark’s outdoor advertising concentration went from approximately 37% of total revenue in Q1-20 to 27% in Q2-20.

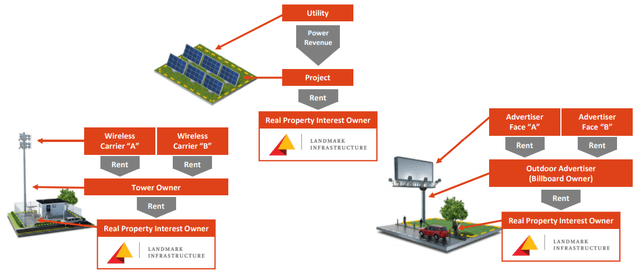

Regardless, it operates with triple-net contracts in this regard. So there are no capital expenditure costs to account for. The tenants are responsible for them, including:

- Clear Channel, which accounts for 13% of total revenue

- Outfront Media, at 6%

- Lamar Advertising (LAMR), at 3%

- Others, at 5%

Landmark also has 70 digital kiosks. These were deployed in the Dallas Area Rapid Transit (DART) project as of August 2020 and is expected to commence revenues in the latter part of 2020.

So yes, the billboard segment still makes up 27% of Landmark’s revenue. In Q2-2, its outdoor advertising rental revenue declined by approximately $250,000 over Q1-20. And the company does anticipate further rent reduction/abatement requests.

It’s also true that, out of an abundance of caution, Landmark reduced its quarterly dividend in April from $0.3675 to $0.20. And, prior to the pandemic, we did suggest concern over its elevated payout ratio.

Even so, the pandemic’s impact hasn’t been nearly as severe as the market’s made it seem.

Today, essentially all U.S. regions are back to normalized outdoor traffic volume. Compare that to the peak of the shutdowns, when they were down as much as 80% in certain markets.

And outdoor traffic improvement is an encouraging sign for outdoor advertising spending to come back to normalized levels.

In Closing…

Landmark’s wireless communication, renewable power, and digital infrastructure segments have performed well. As such, they’re helping offset declines from the outdoor advertising segment.

Besides, Landmark acts more like a bank than a billboard or cell tower operator. So it’s removed from the process of granting rent relief or abatements.

The company is now trading at a deep discount to both net asset value and its peer groups. This includes tower companies, which are trading at about an average of 30x 2020 p/AFFO and 29x analysts’ enterprise value to EBITDA.

By comparison, Landmark is trading at 7.6x and 13.5x, respectively, with an 8.8% yield.

We recently added it to the Small Cap Portfolio – which has returned an annual average of 29% since we opened it in January 2016. This collection’s success is predicated on our vetting system, in which we screen for deep-value picks mispriced by the often irrational Mr. Market.

In this case, he’s focused on the current distribution without realizing that AFFO has held steady. And we aim to take advantage of that mistake with this Strong Spec Buy.

Bottom Line: When buying shares in Landmark Infrastructure, you’re getting 742 billboard spaces for free!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Join the iREIT Revolution! (2-Week FREE Trial)

At iREIT, we’re committed to assisting investors navigate the REIT sector. As part of this commitment, we recently launched our newest quality scoring tool called iREIT IQ. This automated model can be used for comparing the “moats” for over 150 equity REITs and screening based upon all traditional valuation metrics.

[wpforms id=”9787″]

Paid Advertisement