Boston Omaha issued its 2022 annual investor letter. Hard to believe that the company just finished its eighth year. Some of our observations.

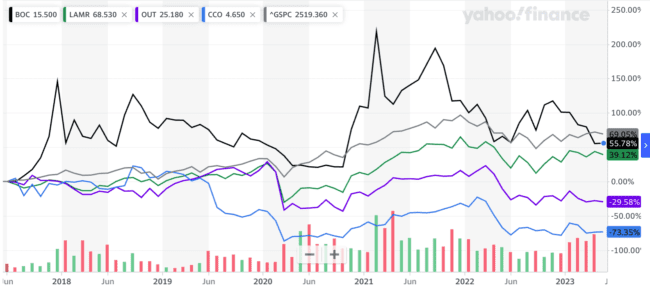

Boston Omaha has outperformed the big three.

Boston Omaha stock has grown 56% since it went public in June 2017. During the same time period Lamar grew 39%, OUTFRONT declined 30% and Clear Channel Outdoor declined 73%. By comparison, the S&P 500 grew 69% over the same time period.

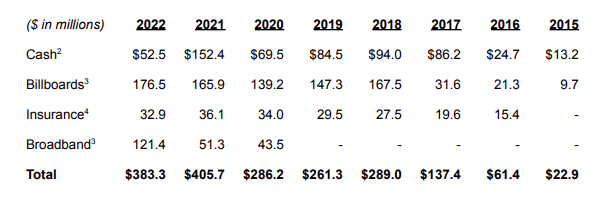

Link Media Outdoor is Boston Omaha’s largest investment.

The company’s Link Media Outdoor billboard subsidiary accounts for almost half of Boston Omaha net assets at December 2022. Broadband is next at one-third of net assets. Here’s a summary of the net assets of each of Boston Omaha’s business segments at December 31, 2022.

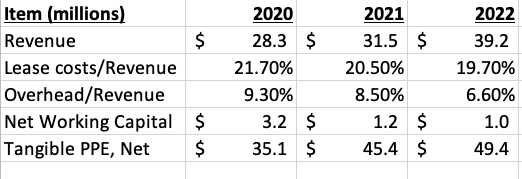

Good lease costs and declining overhead

Here are the operating metrics for Link Media Outdoor which are disclosed in the annual report. We’ve presented the last three years. Link Media lease costs were under 20% of revenue which is the norm for non-urban billboard plants. Overhead (corporate employees and expense) is declining as the company scales. We’d like to see average revenue per billboard face as a sales effectiveness metric.

Plain English Goals

The Boston Omaha letter contains no consultant-speak about leveraging technology to drive scale and maximize shareholder value by prioritizing customer centricity. The strategy is in plain english.

- Always work to align incentives

- Decentralize whenever possible.

- Think long-term

- Focus on cashflow

- Act like a partner.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement