Insider’s Take: Insider believes that there is always something to learn when those outside our industry evaluate the industry. Thanks to Arturo Neto, who wrote this article and The Belgian Dentist who produced this article for Seeking Alpha. We have focused on their comparison of Lamar and Outfront, the industries two REITs. You can read the full article by clicking this link.

Lamar vs. Outfront

Both companies became REITs in 2014 – Outfront after its spin-off from CBS (CBS).

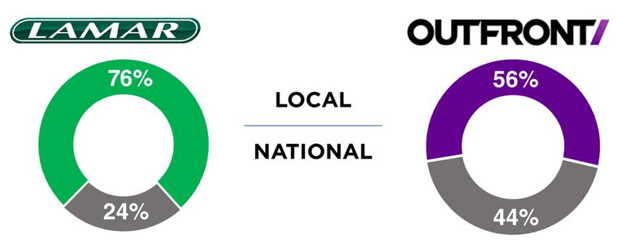

As a pure-play out-of-home advertising company, Lamar Advertising provides mainly local advertising and derives revenues from a diversified customer base, with no single advertiser accounting for more than 1% of the company’s billboard advertising revenue. Lamar has demonstrated discipline historically in managing operating expenses and capital expenditures, which resulted in strong free cash flow generation during the economic downturn in 2008 and 2009. After several years of directing free cash flow to debt reduction, the company has been more acquisitive in recent years and there is the potential for additional debt-financed acquisitions.

Exhibit 10: National vs. local revenues

Outfront Media has positions in all the top markets in the US and Canada. Outfront has generated negative free cash flow after dividends in recent years which has led to higher debt levels, but Outfront has experienced strong revenue and EBITDA growth in the past few quarters that have led to lower overall leverage levels. EBITDA margins are good, but are below the industry average of its US competitors due to its lower margin transit business.

The continued conversion of traditional static billboards to digital is expected to support revenue and EBITDA growth although the company has historically spent less than its largest competitors on digital billboard displays.

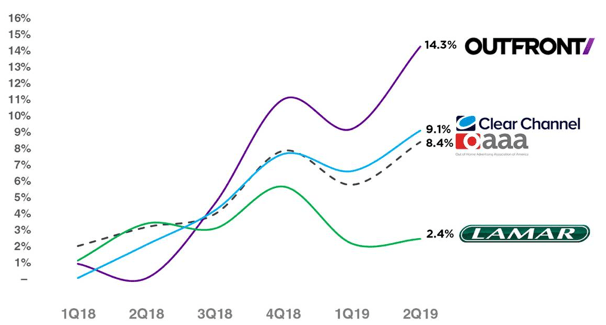

Exhibit 11: Quarterly U.S. revenue growth

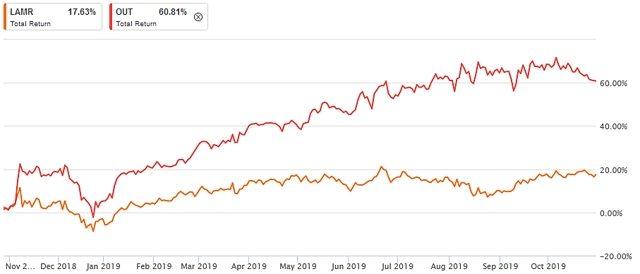

Thanks to its strong growth in recent quarters, Outfront has outperformed Lamar the past year.

Exhibit 12: 1-year total return

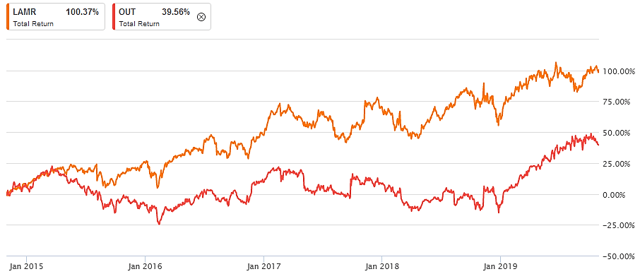

Longer term, Lamar is clearly outperforming Outfront.

Exhibit 13: 5-year total return

A logical next question would be: Is Outfront after the run-up of the last twelve months now more expensive than Lamar?

Before we answer that question we first take a look at the balance sheet strength (and hence dividend safety).

Dividend safety

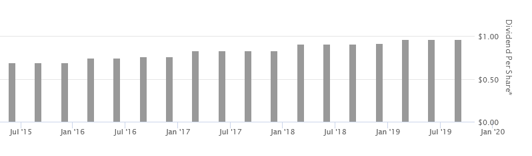

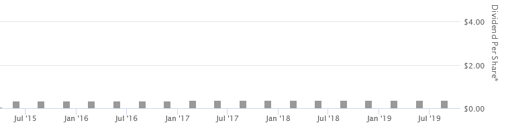

Let’s first take a look at each company’s dividend history. The past five years Lamar grew its dividend every year, while Outfront kept it stable.

Exhibit 14: Lamar Advertising dividend history

Exhibit 15: Outfront Media dividend history

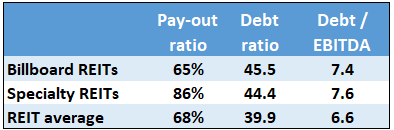

Both billboard REITs are part of the Specialty REIT sector. Compared to the average REIT, Specialty REITs have higher debt ratios and a higher pay-out ratio and hence a lower dividend safety.

The billboard REIT debt ratios are close to those of the specialty REITs while their pay-out ratio is much lower, even lower than the average REIT.

Exhibit 16: Dividend safety

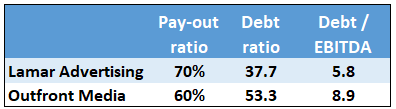

Lamar’s debt ratios are much healthier than those of Outfront. They are even better than the average REIT! Outfront’s pay-out ratio is on the other hand lower than Lamar’s. But the latter has a pay-out ratio more or less in line with the REIT average.

Exhibit 17: Dividend safety

All-in-all we can say that Lamar scores better than Outfront on the level of dividend safety. If the advertising market would indeed slow down as expected in the coming years, this could be very important indeed. On this front Lamar wins the derby.

Valuation

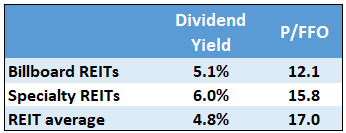

As we said before, both billboard REITs are part of the Specialty REIT sector.

Exhibit 18: Valuation

Specialty REITs are cheaper than the average REIT and within the Specialty REIT sector our two billboard REITs are cheaper than the average specialty REITs based on P/FFO. Based on dividend yield they are a bit more expensive. We will see in a minute that the billboard REITs have a much lower pay-out ratio compared to the average specialty REITs.

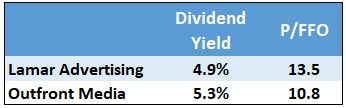

When we compare our billboard REITs, Lamar is slightly more expensive than Outfront.

Exhibit 19: Valuation

Given Lamar’s stronger balance sheet and dividend safety, this higher valuation can be warranted. We can check this by looking how the current valuation compares to both companies’ own history.

Exhibit 20: Lamar Advertising dividend yield

Exhibit 21: Outfront Media dividend yield

While Lamar is currently valued at around the average dividend yield over the past 5 years, this is not the case for Outfront. The latter is very expensive compared to its own history. So valuation-wise, Lamar wins the derby… again.

Conclusion

Owing to the out-of-home advertising market’s sensitivity to U.S. GDP growth, an economic slowdown could weigh on the sector’s future revenue trend path. In such an environment we have a preference for the more defensive player which is in this case Lamar Advertising. Certainly because Lamar was able to generate strong free cash flow during the economic downturn in 2008 and 2009.

Also when we look at dividend growth, dividend safety and valuation, Lamar comes out on top.

So the winner of our billboard REIT derby is: Lamar Advertising!

[wpforms id=”9787″]

Paid Advertisement