If I told you that the economy grew at a 6.9% annual rate in 4th quarter, that we just ended the strongest year of growth in nearly four decades and that the national unemployment rate was at 3.9%, you might be feeling that our future is very bright. You would probably be correct based on those assumptions.

So let’s throw in two other additional data points. The first, that inflation is currently at 7% and second, the Fed has been on record pledging to hold interest rates near zero until inflation was forecast to moderately exceed 2% and until the labor market returned to levels consistent with maximum employment.

Such is our current situation, and so Federal Reserve Chairman, Jerome Powell announced on Wednesday that “the economy no longer needs sustained high levels of monetary support” and as a result, they will be raising the target for the federal funds rate, most likely, in Mid-March. Speculation is that the increase will be 25 basis points (or.25%). In his remarks, Chairman Powell added to his comments, “of course the economic outlook remains uncertain…. we will need to be nimble, so that we can respond to the full range of plausible outcomes”. In Fed speak, that means there will be more rate increases coming and we are not going to tell you when or how much.

And so it begins. Insider wants to focus on a few things this startling change in monetary policy may have to the OOH industry and some initial thoughts on what you might do.

No more easy lending.

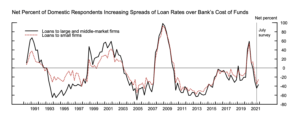

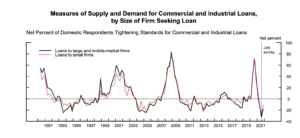

The charts below will provide perspective on the environment the banks have been operating. The charts are courtesy of the Fed and a survey of bank lending officers through October 2021.

The two charts indicate that both bank pricing and lending standards were loosening through the first part of 2021.

It is very safe to assume, heading into an uncertain environment of raising interest rates, that we can expect both of these trends to reverse in the coming year.

In uncertainty, bankers lean toward things they know well.

Historically, the Out of Home industry is NOT something the banking community has known well. If you see your banking contact regularly, that is terrific, and keep it up. If you are not, it is time to get proactive. Set up a meeting, educate them about how strong the industry has been and continue to meet with them, at least quarterly. Make sure they know how strong values are in the marketplace. Insider recently released our list of transactions for the 4th quarter.

A slowing economy might impact buying decisions and ad dollars.

Spend time with your clients. Help them understand and appreciate the value of the services you provide and how much you appreciate their business.

[wpforms id=”9787″]

Paid Advertisement