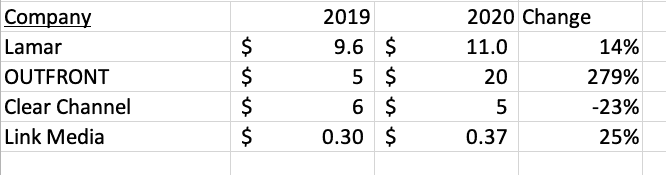

Covid has resulted in an increase in bad debts at the public out of home companies. Here’s a breakout of who took what writeoffs in 2020.

Table 1 – Accounts Receivable Writeoffs for Public US Out of Home Companies (million dollars)

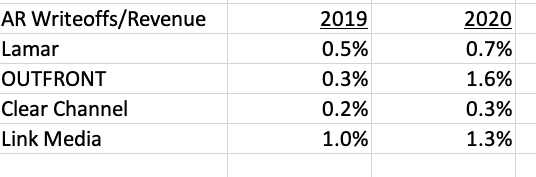

And this table shows writeoffs as a percentage of revenues.

Table 2 – Writeoffs as a percent of revenues for US public out of home companies.

- Accounts receivable writeoffs nearly tripled at OUTFRONT.

- Accounts receivable writeoffs rose by a smaller amount at Lamar and Link Media because their roadside customers were less severely impacted by covid than OUTFRONT’s urban and transit customers.

- Clear Channel writeoffs actually fell during 2020 although it looks to Billboard Insider like it’s simply a timing issue. Clear Channel had low account receivable writeoffs but took a large accounting expense to increase the allowance for uncollectible accounts receivable from $24 million in 2019 to $32 million in 2020. Insider expects that we’ll see the writeoffs happen in 2021.

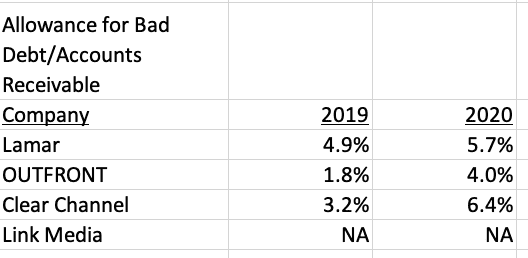

Here’s a breakdown of the allowance for uncollectible receivables at the public out of home companies as a percentage of total receivables. The allowance for uncollectible receivables is an accounting reserve against potential future collection problems. The higher the reserve, the more conservative a company’s accounting.

Table 3 – Allowance for Uncollectible Accounts Receivable as a Percent of Accounts Receivable

- Lamar had the most conservative accounting and the highest reserve going into covid and increased the reserve slightly during covid.

- OUTFRONT more than doubled the allowance for uncollectible accounts over the past year in addition to taking large writeoffs.

- Clear Channel doubled the allowance for uncollectible accounts in 2020 even though it took few writeoffs.

[wpforms id=”9787″]

Paid Advertisement