OUTFRONT leaves Covid with fewer employees, fewer billboard leases and more digital screens. OUTFRONT’s capital spending will increase in 2021 although the increase won’t match Lamar’s increase because OUTFRONT’s markets are taking longer to rebound from covid. Here are 5 things Insider learned from reading OUTFRONT’s 2020 10k.

OUTFRONT leaves Covid with fewer employees, fewer billboard leases and more digital screens. OUTFRONT’s capital spending will increase in 2021 although the increase won’t match Lamar’s increase because OUTFRONT’s markets are taking longer to rebound from covid. Here are 5 things Insider learned from reading OUTFRONT’s 2020 10k.

1. More employee cuts than Lamar

OUTFRONT had a lower margin than Lamar going into Covid and OUTFRONT’s revenue is down more than Lamar’s. Not surprising that OUTFRONT has let more people go. The sales force declined 18% and total employees declined 15% in 2020 after increasing 7% in 2019. Lamar employees dropped only 8%.

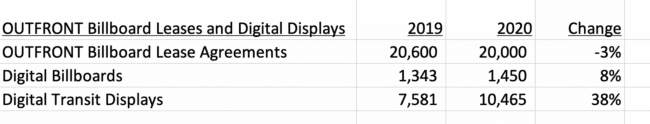

2. Fewer Billboard Leases and more digital displays

The number of billboard leases which OUTFRONT controlled declined by 3% in 2020. Looks like it pruned some poor performing sites just like Lamar did. Digital billboard displays increased by 8% and transit displays increased by 38%.

3. Few Easements.

OUTFRONT doesn’t own many easements The number of easements isn’t disclosed but the 10k says this: “we primarily lease out outdoor advertising sites, but, in a few cases, we own or hold permanent easements on our outdoor advertising sites.” Insider suspects OUTFRONT isn’t buying easements to keep powder dry for the MTA buildout. Insider hears that OUTFRONT is happy to let third parties like Landmark Infrastructure own land under billboard structures.

4. OUTFRONT’s future depends on New York and Los Angeles…and Miami and San Francisco and Washington DC

New York and Los Angeles accounted for more than a third of OUTFRONT’s revenue in 2019. OUTFRONT’s top 5 markets (New York, Los Angeles, Miami, San Francisco and Washington DC) accounted for half of total revenue in 2019. Revenue from these markets was way down in 2020 as you can see below. Outfront’s rebound depends on how rapidly these markets come back.

5. Capital Spending to increase

OUTFRONT cut capital spending by 52% in 2020. We’ve separated MTA outlays and acquisitions from capital expenditures because OUTFRONT reports them separately in the 10k. We expect capital expenditures and MTA spending to rebound first for OUTFRONT, followed by acquisitions.

[wpforms id=”9787″]

Paid Advertisement