Here are five things about Link Media Outdoor which Billboard Insider learned from reading the 2023 10k of Boston-Omaha.

Scale, Scale, Scale

Link Media is a textbook case of taking advantage of scale economies. Revenues have grown faster than expenses in every year of the company’s life. Key expense items (lease costs, utilities and commissions) have been falling as a % of revenues which means that the company’s cashflow margin has grown from 6% in 2017 to 37% in 2023.

Acquisitions every few years.

Link grows by acquisition every few years than spends a year or two integrating the new assets before acquiring another group of assets. There were no major acquisitions in 2023 which suggests Link may be a buyer in 2024 or 2025.

Smaller Markets

Link Media is active in small to medium out of home markets. This is evident when you look at monthly revenue per face ($470/month), monthly revenue per employee ($487,500) and lease costs (19% of revenue). Compare these figures to OUTFRONT which operates in large markets. As you might expect, Link Media has less revenue per employee and less monthly revenue per face but much lower lease expenses.

Low Debt

Boston Omaha’s Co-CEO’s Alex Buffet Rozek and Adam Peterson like to minimize financial risk. Link Media has the lowest leverage of any of the public out of home companies as you can see below.

2023 Total Debt to Cashflow (EBIDTA)

Stable workforce.

Link Media adds employees after major acquisitions. The workforce declined 5% during covid but has been stable since then.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

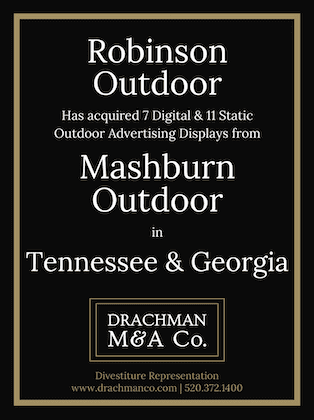

Paid Advertisement