Landmark Infrastructure is a publicly traded REIT which buys out of home easements and leases. Here are five things Insider learned from reading Landmark’s 2018 10k and February 2019 Investor Presentation.

A growing out of home portfolio

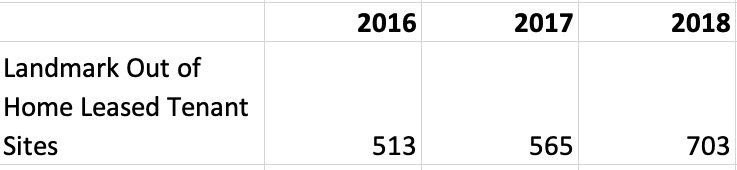

The number of Landmark owned out of home sites grew 24% during 2018 as you can see from the following chart.

Big markets and big leases.

Insider has heard that Landmark is not interested in a lease unless the monthly rent is greater than $300/month. The underwriting and documentation costs don’t justify the investment for small leases. 80% of Landmark’s out of home leases are in top 100 BTA markets. The average revenue for a Landmark out of home lease is $1,527/month which suggests a focus on larger markets.

Aggressive marketing.

Landmark reps hold 15,000 meetings a year with potential wireless, outdoor and renewable energy site owners concerning a sale. Insider gets frequent letters from Landmark asking if he wishes to sell any billboard leases or easements. Are you sending letters to your landlords asking them if they’d like to sell an easement or lease. You can be sure Landmark is.

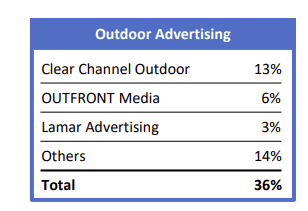

Clear Channel is Landmark’s biggest out of home tenant.

Clear Channel Outdoor accounts for 13% of Landmark’s quarterly outdoor advertising revenues. See box on right which summarizes the biggest Landmark out of home clients as a % of Landmark’s quarterly out of home revenue. Insider was once asked to advise a landlord on the sale of a lease. Clear Channel Outdoor was the tenant. Insider asked Clear Channel if it wished to buy an easement or lease and was told to contact Landmark. Insider can’t imagine Lamar giving such a response.

A concentration in the South and Texas

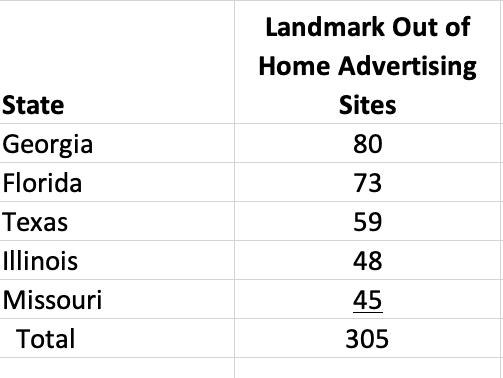

Here are the five states in which Landmark owns the most out of home sites.

[wpforms id=”9787″]

Paid Advertisement