Here are six things about Clear Channel Outdoor which Billboard Insider learned from reading the Clear Channel Outdoor 2021 10k.

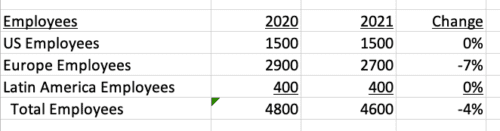

Fewer employees in Europe

European employees dropped by 7% in 2020. US and Latin American employees were flat.

\

\

More Digital Revenues

Digital revenues have been steadily increasing as the company converts static displays to digital.

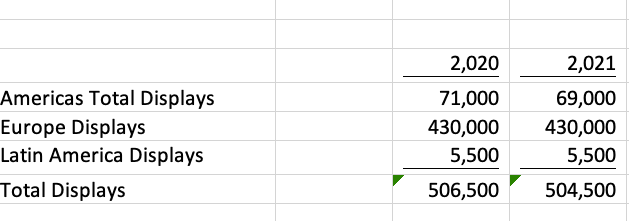

Fewer Displays

Clear Channel Outdoor ended 2021 with 3% fewer displays in the Americas. European and Latin American Displays were stable.

We won’t say anything about a sale until we do.

Don’t expect breathless announcements about how the Europe sale is going: “In December 2021, we announced that our Board authorized a review of strategic alternatives for our European business, including a possible sale. There can be no assurance that the strategic review process will result in any transaction or particular outcome. We have not set a timetable for a completion of the review, may suspend the process at any time and do not intend to make further announcements regarding the process unless and until the Board approves a course of action…” Clear Channel’s execs ducked sale questions on their most recent earnings call.

26 countries which is 24 too many.

Clear Channel is in 26 countries. This is a bug, not a feature. There are no benefits from international diversification. It makes the company hard to analyze and understand. It reduces management focus. A spinoff of Europe and Latin America can’t happen too soon in Billboard Insider’s view. Lamar outperforms Clear Channel Outdoor in part because it avoids international distractions.

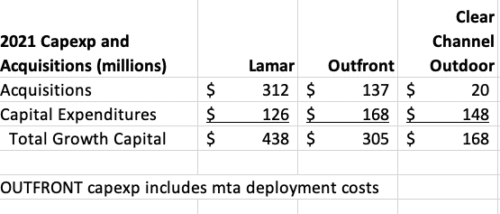

High leverage means there’s less money to grow.

Clear Channel Outdoor’s 2021 interest expense of $350 million equals cashflow EBIDTA of $356 million. Kudos to the Clear Channel Outdoor team for avoiding a default but high debt service means there’s little money to grow and things only get worse when interest rates rise as they are doing. Lamar and OUTFRONT spend 2-3 times more on growth capital than Clear Channel Outdoor because they don’t have to give as much to lenders.

[wpforms id=”9787″]

Paid Advertisement