The bond rating document for the Adams $505 million debt issue tells you four things about Adams and Fairway’s operations.

The bond rating document for the Adams $505 million debt issue tells you four things about Adams and Fairway’s operations.

The billboards which are pledged as collateral for the debt issue do not constitute all of Adams and Fairways billboards but are a large enough sample to provide insights into how Adams and Fairway operate. Adams and Fairway are separate legal entities but share common management.

A mid-market focus which seeks to dominate

The rating document says this about Adam’s strategy:

“Adams focuses primarily on mid-size markets where it is the dominant provider of outdoor advertising with an average market share of approximately 84%.”

Here are the 10 markets which are included in the debt issue:

- Ann Arbour, MI

- Beaufort, SC

- Champaign, IL

- Charleston, SC

- Charlotte, NC

- Florence, SC

- Kalamazoo, MI

- Lansing, MI

- Madison/Kenosha, WI

- Norfolk, VA

- Eastern PA

- Peoria, IL

A focus on mid-sized markets and high market penetration mean that Adams keeps rates high and lease costs low as you can see below.

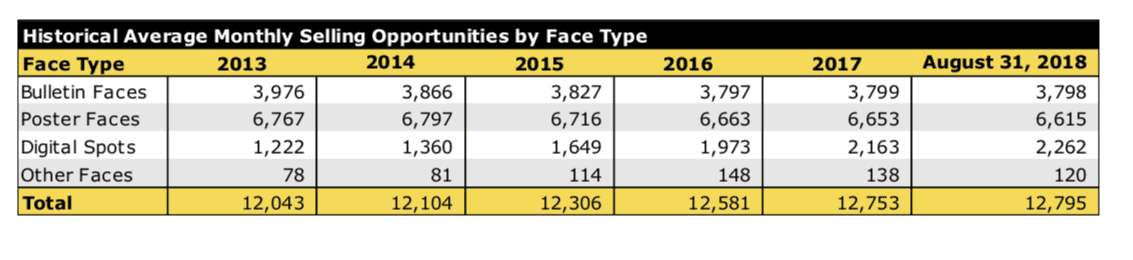

Faces are increasing due to digital conversions.

The number of faces in the portfolio has grown by 1.2%/year over the past five years. Digital signs account for all the increase as you can see in this table.

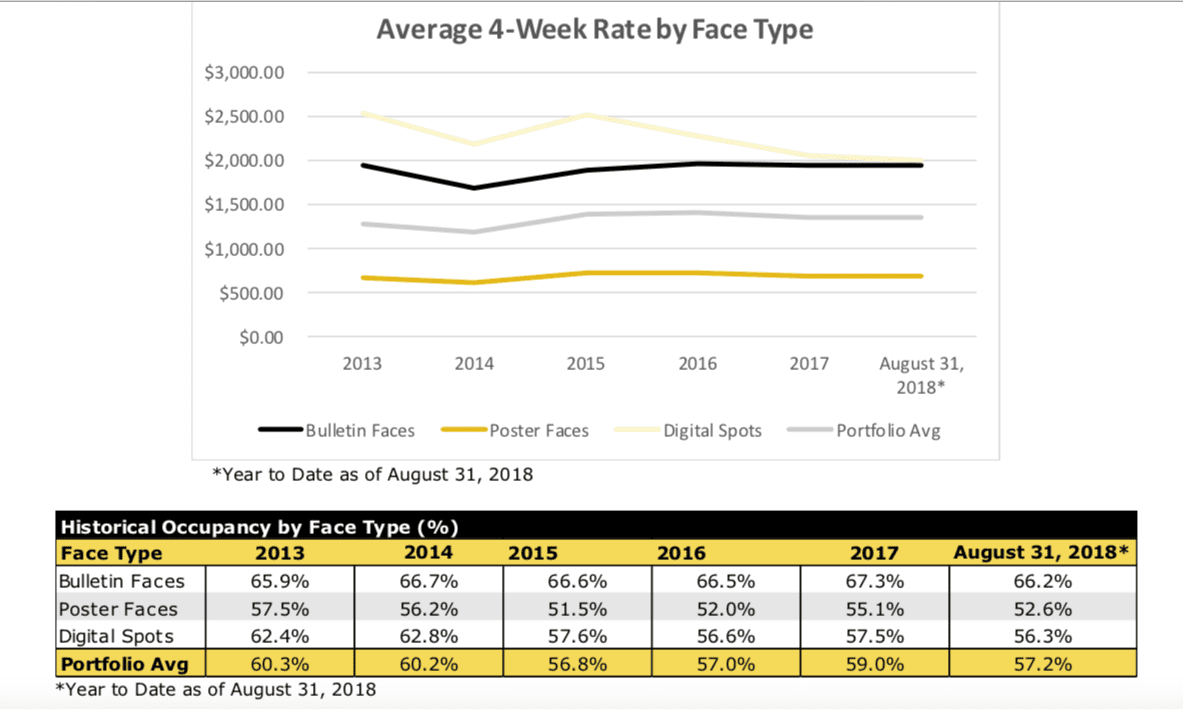

Adams will accept vacancies to achieve rate.

Insider has heard people say that Adams and Fairway are willing to accept higher than normal vacancies if it means it can hold the line on rates. The numbers bear this out. The Adams billboards have an average revenue per period of approximately $2,000 which seems pretty strong for mid-markets. Occupancy, however, was only 57% at August 2018. Insider considers 20% vacancy the norm for the out of home business. Look at this table from the debt offering. The average 4 week rate by face type is show first, followed by vacancies.

Reasonable lease costs

Lease costs are 15% of revenues for the Adams billboards, slightly below the 19% which Lamar achieved during 2017. Lower lease costs reflect the lack of large markets and the fact that most of Adam’s billboards are non-conforming so Adams has a strong negotiating position versus a landlord (if a billboard comes down it can’t be replaced).

Adams owns 14% of the land under its structures and leases 86% of the land under its structures.

The average lease cost per site is $391/month, calculated as follows (Leasing expense of $20.0 million for trailing twelve months ended August 2018 divided by 4,264 sites divided by 12).

[wpforms id=”9787″]

Paid Advertisement