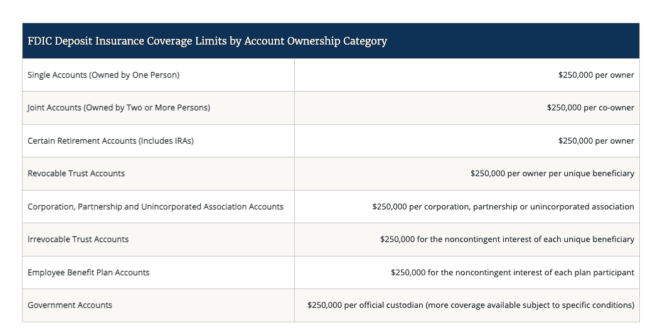

Silicon Valley Bank failed over the weekend. Silicon Valley bank was the 16th largest bank in the US. It specialized in banking startup tech companies. In the 90’s Silicon Valley Bank funded media companies including out of home but exited the sector. The failure of Silicon Valley could be a big event because many startups kept all their cash there. Roku, for example kept $487 million in cash at Silicon Valley. Here’s the problem. The FDIC only guarantees $250,000 per account in banks. Look at the FDIC insurance rules.

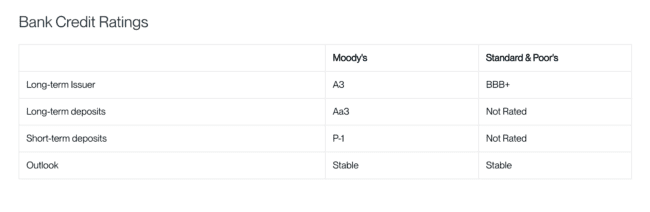

You can’t assume you’re safe just by looking at your bank’s bond ratings. Bank runs happen fast. Look at the credit ratings Silicon Valley Bank posted on its website on the day it collapsed.

Billboard Insider’s take: It’s a good idea to limit your bank deposits to $250,000 or less. Once you get above that amount, buy treasury bills or open a government securities money market account. You’ll earn interest on your money (a 1 month tbill was at 4.8% as of Friday), your funds won’t be frozen or lost if your bank becomes insolvent and you won’t have cash lying around to tempt employers or hackers. Penneco Oil, the parent of Penneco Outdoor had $3.5 million of cash stolen over Labor Day weekend 2012 by hackers. Penneco Oil managed to recover the money. Most hacked companies aren’t so lucky.

To receive a free morning newsletter with each day’s Billboard insider articles email info@billboardinsider.com with the word “Subscribe” in the title. Our newsletter is free and we don’t sell our subscriber list.

Paid Advertisement